The following represents the trial balance extracted from the books of Mr Jones, a small businessman based

Question:

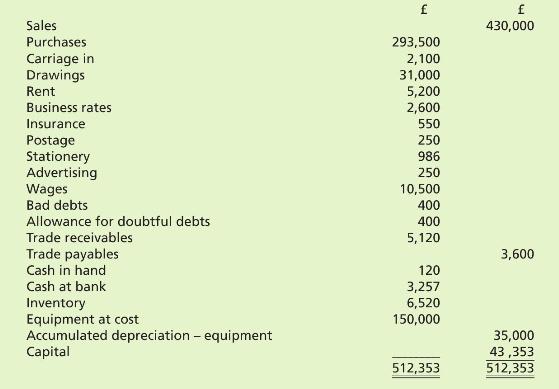

The following represents the trial balance extracted from the books of Mr Jones, a small businessman based in Aboyne, Scotland. The books are well-maintained and there is no reason to doubt the accuracy of the entries.

Following a discussion with Mr Jones, the following points have come to light:

(a) Accruals are necessary for rent ( \(£ 150\) ), business rates ( \(£ 200\) ), and stationery ( \(£ 16\) ).

(b) Insurance has been prepaid by \(£ 150\), advertising by \(£ 50\).

(c) Inventory at the year-end is \(£ 7,000\).

(d) Depreciation is to be charged on the equipment at a rate of 10 per cent on cost.

(e) The allowance for doubtful debts is to be increased to 10 per cent of the year-end balance.

(f) Purchase invoices to the value of \(£ 12,000\) were found in a desk drawer the day before the meeting with Mr Jones. Half of them have been paid by cheque (but no record made in the cash book) and the rest are outstanding.

Required

(a) Prepare an income statement for the year ending on the date of extraction of the trial balance together with a balance sheet as at that date.

(b) Mr Jones has kept accurate records (with the exception of point (f)) and yet the accountant must still adjust the figures in the trial balance before preparing the financial statements. As the accountant, write a letter to Mr Jones outlining why the accountant must adjust the figures to convey meaningful information.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood