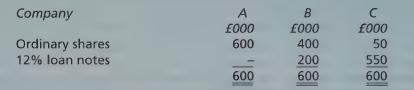

Three companies have the capital structures shown below. The return on capital employed was 20% for each

Question:

Three companies have the capital structures shown below.

The return on capital employed was 20% for each firm in 2006, and in 2007 was 10%. Corporation tax in both years was assumed to be 55%, and loan note interest is an allowable expense against corporation tax.

(a) Calculate the percentage return on the shareholders’ capital for each company for 2006 and 2007. Assume that all profits are distributed.

(b) Use your answer to explain the merits and the dangers of high gearing.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster

Question Posted: