Xzibita Ltd is a wholesaler of womens clothing. The trial balance below has been extracted from the

Question:

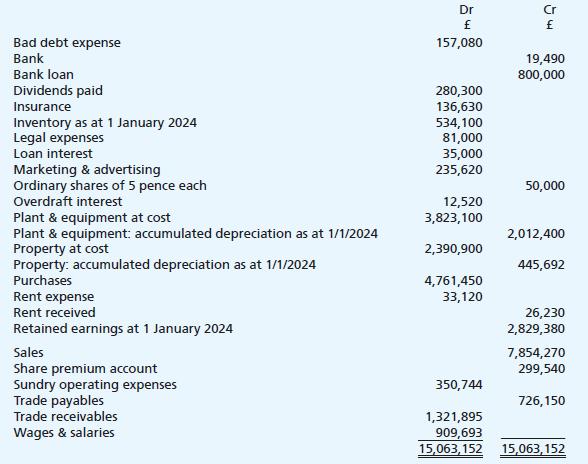

Xzibita Ltd is a wholesaler of women’s clothing. The trial balance below has been extracted from the nominal ledger of the company as at 31 December 2024:

No adjustments have yet been made in relation to the following matters:

(i) Inventory was counted on 31 December 2024 and valued at a total cost of £588,390. This total includes a batch of 700 coats which had originally cost £90 each and are normally sold by Xzibita Ltd for £160 each. Due to a defect in manufacture, they were all sold on 14 January 2025 at 50%

of their normal price. Selling expenses amounted to 10% of the proceeds.

(ii) Included in the balance for insurance in the above trial balance is an insurance premium of £53,472 paid on 15 April 2024, which represented 12 months’ insurance to 31 May 2025.

(iii) The company acquired a new building during the year, the purchase price of which is included in the figure for property at cost on the above trial balance. Legal fees of £81,000 were incurred in direct connection with this acquisition and these have been debited to the legal expenses account.

(iv) Company policy is to depreciate property on a straight-line basis over 50 years assuming a zero residual value. Plant & equipment is to be depreciated at 25% using the reducing balance method. A full year’s charge is applied in the year of acquisition and none in the year of disposal.

(v) Rent paid of £11,040 has been debited to the rent received account in error.

(vi) Xzibita Ltd employs the services of an external marketing agency. During December 2024, marketing expenses amounting to £29,740 were incurred for which no invoices have yet been received.

(vii) Various old debit balances on the purchases ledger totalling £3,890 need to be written off.

(viii) Cheque payments amounting to £13,310 had been correctly entered in the books in December but did not appear on the business’s bank statements until January 2025. Cheques received from customers totalling £7,560 were correctly entered in the cash book on 30 December 2024 and banked on the same day but these did not appear on the bank statement until 2 January 2025.

(ix) The bank loan of £800,000 was originally received on 1 June 2023 and is due to be repaid in full on 31 May 2028. Interest, at a fixed annual rate of 5.25%, is paid in arrears on a quarterly basis on 1 March, 1 June, 1 September and 1 November each year. Interest accrued but not yet paid has not yet been accounted for.

(x) The corporation tax charge on the profit for the year is estimated to be £158,090 (this estimate is unaffected by the various matters above).

Required:

In a form fit for publication, prepare the income statement for Xzibita Ltd for its year ended 31 December 2024 and a balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood