Yaso is in business buying and selling goods on credit. He is concerned that although his business

Question:

Yaso is in business buying and selling goods on credit. He is concerned that although his business is making a good profit, his balance at the bank is not increasing. The following information is available:

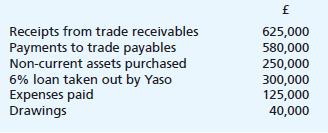

1 At 1 September 2022, the bank balance was £40,000, and the inventory was £35,000 2 Summarised bank transactions for the year ended 31 August 2023.

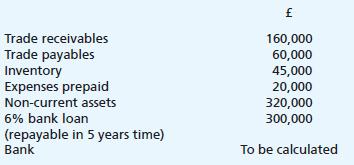

3 Asset and liabilities at 31 August 2023.

4 Credit transactions in the year ended 31 August 2023.

\section*{Required}

(a) Explain the accounting terms:

(i) profitability (ii) liquidity.

(b) Calculate the bank balance at 31 August 2023.

(c) Calculate, for the year ended 31 August 2023, the:

(i) Inventory turnover (times)

(ii) current ratio (iii) liquid (acid test) ratio (iv) trade payables payment period (in days)

(v) trade receivables collection period (in days)

(vi) revenue to non-current assets.

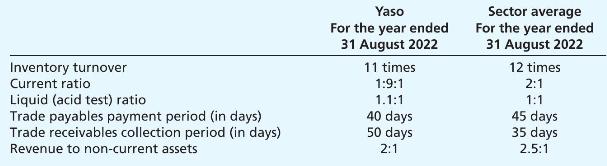

The following information is available for Yaso's business for the previous year, ended 31 August 2022, and for the sector average for the year.

(d) Evaluate the liquidity of Yaso's business at 31 August 2023.

A friend of Yaso's stated that you cannot judge the success of a business by financial factors alone. You must also consider non-financial factors.

(e) Identify four non-financial factors that could be important when judging the success of Yaso's business.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood