You are presented with the following information from the Seneley group of companies for the year to

Question:

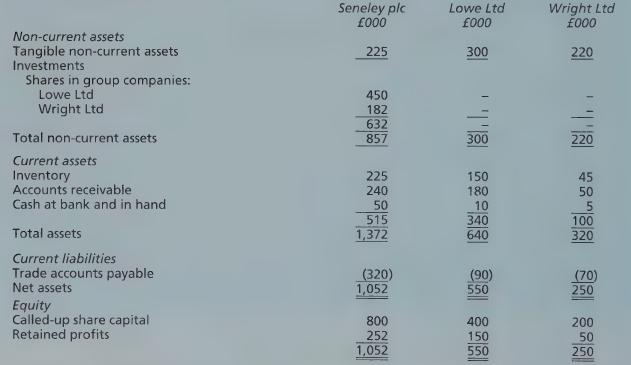

You are presented with the following information from the Seneley group of companies for the year to 30 September 2006:

Additional information:

(a) The authorised, issued and fully paid share capital of all three companies consists of £1 ordinary shares.

(b) Seneley purchased 320,000 shares in Lowe Ltd on 1 October 2003, when Lowe’s retained profits balance stood at £90,000.

(c) Seneley purchased 140,000 shares in Wright Ltd on 1 October 2005 for £130,000, when Wright's retained profits balance stood at £60,000. The £52,000 negative goodwill was recognised immediately in Seneley’s profit or loss.

(d) During the year to 30 September 2006, Lowe had sold goods to Wright for £15,000. These goods had cost Lowe £7,000, and Wright still had half of these goods in inventory as at 30 September 2006.

(e) Included in the respective trade accounts payable and trade accounts receivable balances as at 30 September 2006 were the following intercompany debts:

• Seneley owed Wright £5,000 • Lowe owed Seneley £20,000 • Wright owed Lowe £25,000.

Required:

Prepare the Seneley group's consolidated balance sheet as at 30 September 2006. Your workings should be submitted.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273712138

11th Edition

Authors: Frank Wood, Alan Sangster