After comparing the cash journals for June 20x2, and bank reconciliation statement as at 31 May 20x2

Question:

After comparing the cash journals for June 20x2, and bank reconciliation statement as at 31

May 20x2 of Pintorico Traders with their bank statement as at 30 June 20x2, these differences were found:

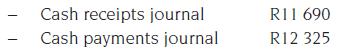

• Pencil totals from the cash journals at 30 June 20x2:

• Balance (debit) of the bank account in the general ledger as at 31 May 20x2, R135.

• Balance (favourable) as per bank statement at 30 June 20x2, R450.

• Items that appeared on the bank reconciliation statement as at 31 May 20x2 but not on the bank statement for June:

– Cheque 511 issued to L. Marques on 28 April 20x2, R105.

• Items that appeared on the bank statement but not in the cash receipts journal and cash payments journal:

– Bank charges, R28.

– Interest on bank overdraft, R32.

– A stop order for an annual donation to the Bohemia Music School, R100.

– An R/D cheque that was originally received from receivable, C. Carlos, R140.

– A deposit that was paid directly into the bank account by a tenant, C. Fidel, R500.

• Items that appeared in the cash receipts journal and cash payments journal but not on the bank statement:

![]()

You are required to:

1. Complete the cash receipts journal and cash payments journal for June 20x2 by commencing with the given totals. Show only the bank columns.

All entries in the cash journals must show the correct contra ledger accounts.

2. The bank account in the general ledger in respect of June 20x2, properly balanced.

3. The bank reconciliation statement as at 30 June 20x2 commencing with the balance as per bank statement.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit