Aztec Oil Company, an integrated producer, has an unproved property with acquisition and capitalized G&G costs of

Question:

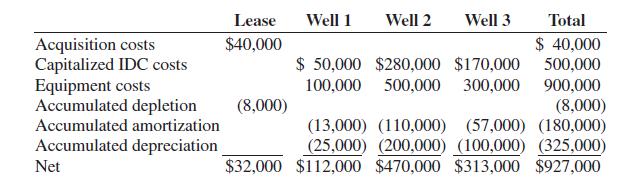

Aztec Oil Company, an integrated producer, has an unproved property with acquisition and capitalized G&G costs of $35,000. Aztec also has a proved property with the following costs:

REQUIRED: Determine the amount of the tax loss in each of the following situations:

a. Aztec drilled a dry hole on the unproved property costing $250,000 for IDC and $60,000 for equipment. Equipment worth $10,000 was salvaged.

b. As a result of the dry hole, Aztec decided to abandon the unproved property.

c. Aztec abandoned Well 1 on the proved property. Wells 2 and 3 are still producing. Assume that the wells had been depreciated separately.

d. Assume that instead of the circumstances in part

c, Aztec abandoned the entire lease, and that equipment worth $27,000 was salvaged.

Step by Step Answer: