Fancy Foods produces gourmet gift baskets that it distributes online as well as from its small retail

Question:

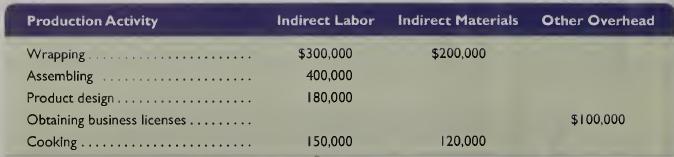

Fancy Foods produces gourmet gift baskets that it distributes online as well as from its small retail store. The following details about overhead costs are taken from its records

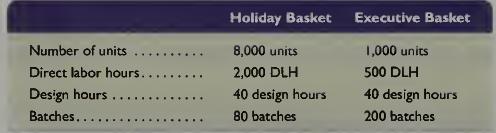

Additional information on the drivers for its production activities follows.

Wrapping. 100,000 units Assembling. 20,000 direct labor hours Productdesign. 3,000 design hours Obtaining business licenses. 20,000 direct labor hours Cooking. 1,000 batches Required 1. Compute the activity overhead rates using ABC. Form cost pools as appropriate.

2. Determine the overhead cost to assign to the following jobs using ABC.

3. What is the overhead cost per unit for the Holiday Basket? What is the overhead cost per unit for the Executive Basket?

4. If the company used a plantwide overhead rate based on direct labor hours, what is the overhead cost for each Holiday Basket unit? What would be the overhead cost for each Executive Basket unit if a single plantwide overhead rate is used?

5. Compare the overhead costs per unit computed in requirements 4 and 5 for each job. Which cost assignment method provides the most accurate cost? Explain

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta