Indicate whether each of the following items is a directly attributable operating expense (D), an allocable operating

Question:

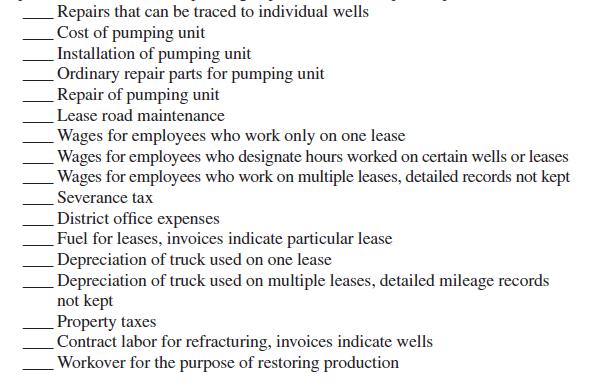

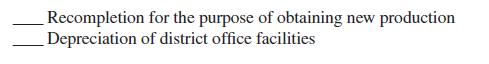

Indicate whether each of the following items is a directly attributable operating expense (D), an allocable operating expense (A), or a capital expenditure (C):

Transcribed Image Text:

Repairs that can be traced to individual wells Cost of pumping unit Installation of pumping unit Ordinary repair parts for pumping unit Repair of pumping unit Lease road maintenance Wages for employees who work only on one lease Wages for employees who designate hours worked on certain wells or leases Wages for employees who work on multiple leases, detailed records not kept Severance tax District office expenses Fuel for leases, invoices indicate particular lease Depreciation of truck used on one lease Depreciation of truck used on multiple leases, detailed mileage records not kept Property taxes Contract labor for refracturing, invoices indicate wells Workover for the purpose of restoring production

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

1 Repairs that can be traced to individual wells D Directly attributable operating expense 2 Cost of ...View the full answer

Answered By

Sandip Agarwal

I have an experience of over 4 years in tutoring. I have solved more than 2100 assignments and I am comfortable with all levels of writing and referencing.

4.70+

19+ Reviews

29+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

how can I get the kernel and the prior predictive distribution of the Exponential (0) univariate one- parametric distribution? I used Jeffrey's rule to obtain the posterior distribution of 0, and I...

-

Indicate whether each of the following items is a variable (V), fixed (F), or mixed (M) cost and whether it is a product/ service (PT) or period (PD) cost. If some items have alternative answers,...

-

Factor each polynomial. 64y 9 + z 6

-

What is the effect on total taxes if a corporation with $200,000 of taxable income pays a bonus of $50,000 to its single shareholder-owner who has $100,000 of other taxable income and is taxed at...

-

Compared with the Kyoto Protocol, the flexibility of the Paris Agreement is a strength, not a weakness. Discuss.

-

What are some of the ways capacity available can be altered in the short run? LO.1

-

The items that follow are from the Income Statement columns of winters Repair Shops work sheet for the year ended December 31, 2014. Prepare journal entries to close the revenue, expense, Income...

-

Sunland Diesel owns the Fredonia Barber Shop. He employs 6 barbers and pays each a base rate of $1,380 per month. One of the barbers serves as the manager and receives an extra $540 per month. In...

-

Texas Oil Company operates solely in the United States. The following amounts are paid during June 2018 relating to producing leases: REQUIRED: Record the above transactions. Fuel for Lease A........

-

What factors are important in determining whether to plug or complete a well?

-

The periodic table of elements is called periodic because (a) The chemical properties always repeat themselves in repeating intervals of atomic number. (b) The elements in a group have similar...

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,200 cases of Oktoberfest-style beer from a German supplier for 264,000 euros. Relevant U.S. dollar exchange rates for the euro...

-

Finding Confidence Intervals. In Exercises 9-16, assume that each sample is a simple random sample obtained from a population with a normal distribution. Body Temperature Data Set 5 "Body...

-

19 Part 2 of 2 1.25 points Skipped Required information Problem 6-4A & 6-5A (Algo) [The following information applies to the questions displayed below.] Gerald Utsey earned $48,400 in 2021 for a...

-

Describe equilibrium constants with words and equations. is the ratio of the concentrations of products to the concentration of reactants present in a reaction mixture when chemical equilibrium is...

-

Pronghorn Inc. acquired 20% of the outstanding common shares of Gregson Inc. on December 31, 2019. The purchase price was $1,133,000 for 51,500 shares, and is equal to 20% of Gregson's carrying...

-

Amazon.com has become one of the most successful online merchants. Two measures of its success are sales and net income/loss figures. They are given here. a. Produce a time-series plot for these...

-

For each equation, (a) Write it in slope-intercept form (b) Give the slope of the line (c) Give the y-intercept (d) Graph the line. 7x - 3y = 3

-

Wearables have the potential to change the way organizations and workers conduct business. Discuss the implications of this statement.

-

How would a business process such as ordering a product for a customer in the field be changed if the salesperson were wearing a smartwatch equipped with Salesforce software?

-

What management, organization, and technology issues would have to be addressed if a company were thinking of equipping its workers with wearable computing devices?

-

1. (A nice inharitage) Suppose $1 were invested in 1776 at 3.3% interest compounded yearly a) Approximatelly how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000?...

-

Why Should not the government subsidize home buyers who make less than $120K per year. please explain this statement

-

Entries for equity investments: 20%50% ownership On January 6, 20Y8, Bulldog Co. purchased 25% of the outstanding common stock of $159,000. Gator Co. paid total dividends of $20,700 to all...

Study smarter with the SolutionInn App