Karim Enterprises has two hourly employees, Kala and Carl. Both employees earn overtime at the rate of

Question:

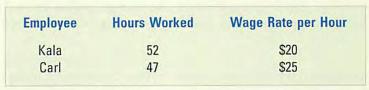

Karim Enterprises has two hourly employees, Kala and Carl. Both employees earn overtime at the rate of \(11 / 2\) times the hourly rate for hours worked in excess of 40 per week. Assume the Social Security tax rate is 6 percent on the first \(\$ 110,000\) of wages and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kala and Carl was \(\$ 250\) and \$220 respectively. The following information is for the first week in January 2010:

Required

a. Calculate the gross pay for each employee for the week.

b. Calculate the net pay for each employee for the week.

c. Prepare the general journal entry to record payment of the wages.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: