Mester Company has 10 employees. FICA Social Security taxes are 6.2% of the first $110,100 paid to

Question:

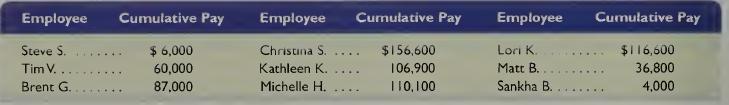

Mester Company has 10 employees. FICA Social Security taxes are 6.2% of the first $110,100 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.8% and SUTA taxes are 5.4% of P2 pq the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows.

a. Prepare a table with the following column headings: Employee; Cumulative Pay; Pay Subject to FICA Social Security Taxes; Pay Subject to FICA Medicare Taxes; Pay Subject to FUTA Taxes; Pay Subject to SUTA Taxes. Compute the amounts in this table for each employee and total the columns.

b. For the company, compute each total for: FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. {Hint: Remember to include in those totals any employee share of taxes that the company must collect.) (Round amounts to cents.)

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta