Rain Company owns 100% of the working interest in a fully developed lease on which there is

Question:

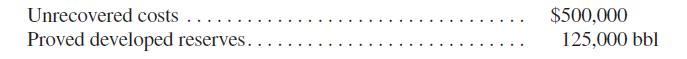

Rain Company owns 100% of the working interest in a fully developed lease on which there is a 1/8 royalty interest. The lease has the following capitalized costs and reserve data as of January 1, 2019:

On January 1, 2019, Rain Company carves out a $400,000 production payment to Post Company. The production payment is payable to Post Company by delivery of 6,250 barrels out of the first 50% of Rain’s share of production. During 2019, production totaled 4,000 barrels of oil, production costs totaled $50,000, and the average selling price was $80/bbl. Ignore production taxes and assume Rain pays the royalty interest owner.

REQUIRED:

a. Give all the entries made by Rain Company (a successful efforts company)

relating to the above lease and to account for the carved-out production payment during 2019.

b. Give all the entries made by Post Company (a successful efforts company) to account for the production payment during 2019.

Step by Step Answer: