Refer to the opening feature about Faithful Fish. Assume that Chelsea Eubank reports current annual sales at

Question:

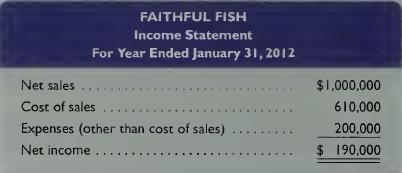

Refer to the opening feature about Faithful Fish. Assume that Chelsea Eubank reports current annual sales at approximately $1 million and discloses the following income statement

Chelsea Eubank sells to various individuals and retailers, ranging from small shops to large chains. Assume that she currently offers credit terms of 1/15, n/60, and ships FOB destination. To improve her cash flow, she is considering changing credit terms to 3/10, n/30. In addition, she proposes to change shipping terms to FOB shipping point. She expects that the increase in discount rate will increase net sales by 9%, but the gross margin ratio (and ratio of cost of sales divided by net sales) is expected to remain unchanged. She also expects that delivery expenses will be zero under this proposal; thus, expenses other than cost of sales are expected to increase only 6%.

Required 1. Prepare a forecasted income statement for the year ended January 31, 2013, based on the proposal.

2. Based on the foreeasted income statement alone (from your part 1 solution), do you reconmiend that Chelsea implement the new sales policies? Explain.

3. What else should Chelsea consider before deciding whether or not to implement the new policies? Explain.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta