Sager Company manufactures variations of its product, a technopress, in response to custom orders from its customers.

Question:

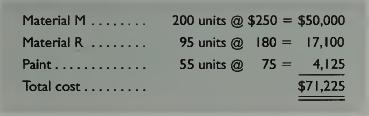

Sager Company manufactures variations of its product, a technopress, in response to custom orders from its customers. On May 1, the company had no inventories of goods in process or finished goods but held the following raw materials.

On May 4, the company began working on two technopresses: Job 102 for Worldwide Company and Job 103 for Reuben Company.

Required Using Exhibit 19.2 as a guide, prepare job cost sheets for jobs 102 and 103. Using Exhibit 19.4 as a guide, prepare materials ledger cards for Material M, Material R, and paint. Enter the beginning raw materials inventory dollar amounts for each of these materials on their respective ledger cards. Then, follow the in¬ structions in this list of activities.

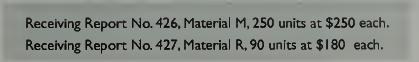

a. Purchased raw materials on credit and recorded the following information from receiving reports and invoices.

Instructions: Record these purchases with a single journal entry. Enter the receiving report information on the materials ledger cards.

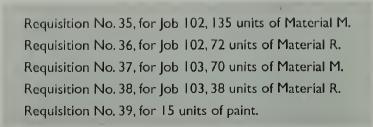

b. Requisitioned the following raw materials for production.

Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect material amount on the materials ledger card. Do not record a journal entry at this lime.

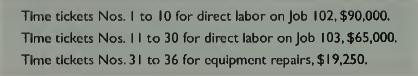

c. Received the following employee lime tickets for work in May

Instructions: Record direct labor from the time tickets on the job cost sheets. Do not record a journal cnlry at this lime.

d. Paid cash for Ihe following items during the month: factory payroll, $174,250, and miscellaneous overhead items, $102,()()().

Instructions: Record these payments with journal entries.

e. Einished .lob 102 tind transferred it to the warehouse. The company assigns overhead to each job with a predetermined overhead rate equal to 80% of direct labor cost.

Instructions: Enter the alU)cated overhead on the cost sheet for Job 102, fill in the cost summary section of the cost sheet, and then mark the cost sheet “Finished.” Prepare a journal entry to record the job’s completion and its transfer to Finished Goods.

f. Delivered Job 102 and accepted the customer’s promise to pay $400,000 within 30 days. Instructions: Prepare journal entries to record the sale of Job 102 and the cost of goods sold.

g. Applied overhead to Job 103 based on the job’s direct labor to date.

Instructions: linter overhead on the job cost sheet but do not make a journal entry at this time.

h. Recorded the total tlirccl and indirect materials costs as reported on all the requisitions for the month. Instructions: Prepare a journal entry to record these costs.

i. Recoiticd the total direct and indirect labor costs as reported on all time tickets for the month. Instructions: Prepare a journal entry to record the.se costs.

j. Recordctl the total overliead costs applied to jobs.

Instructions: Prepare a journal entry to record the allocation of these overhead costs.

k. C’ompute Ihe balance in the Factory Overhead account as of the end of May.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9780077716660

21st Edition

Authors: John Wild, Ken Shaw, Barbara Chiappetta