This information for Ying Yong (Pty) Ltd was extracted from the companys financial statements on the last

Question:

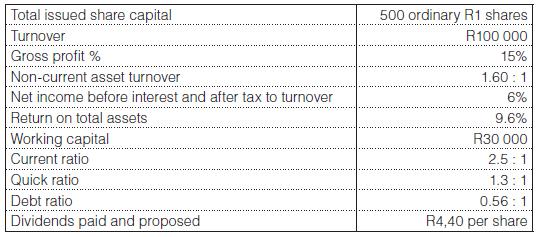

This information for Ying Yong (Pty) Ltd was extracted from the company’s financial statements on the last day of the financial year, 31 December 20x9.

Additional information:

• Assume that taxation is calculated at 50% of net profit before taxation.

• Interest expense is 40% of net income after taxation.

You are required to:

In draft form, construct the statement of profit or loss & other comprehensive income of Ying Yong (Pty) Ltd for the year ended 31 December 20x9 and the statement of financial position at that date, from the information given. You need only give the necessary details that you are able to extract from the information supplied above, but your net profit at the end of the year must be accurate and statement of financial position totals must agree.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit