This information is for Ngama Manufacturers for the year ending 31 December 20x1: You are required to:

Question:

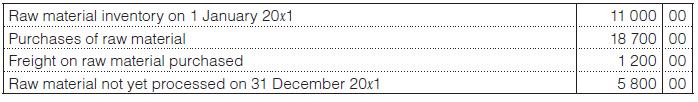

This information is for Ngama Manufacturers for the year ending 31 December 20x1:

You are required to:

Calculate the cost of raw material used as at 31 December 20x1.

Transcribed Image Text:

Raw material inventory on 1 January 20x1 Purchases of raw material Freight on raw material purchased Raw material not yet processed on 31 December 20x1 11 000 00 18 700 00 1 200 00 5 800 00

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

To calculate the cost of raw material used as of 31 December 20x1 you can use the following f...View the full answer

Answered By

Ma Kristhia Mae Fuerte

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit

Question Posted:

Students also viewed these Business questions

-

Write C++ statement(s) to accomplish each of the following: 12 a) Sum the even integers between 1 and 10 using a for statement. Assume that the integer variables sum and count have been declared. b)...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

PT. Sultan Food sells food and variety snacks and cake. The company has one restaurant location and serves catering orders for offices. So far, all dishes are made by themselves using family recipes...

-

The following data have been extracted from the financial statements of Prentiss, Inc., a calendar-year merchandising corporation: Total sales for 2018 were $1,200,000 and for 2017 were $1,100,000....

-

Why do management accountants use sensitivity analysis?

-

Briefly explain why firms might use nonfinancial performance measures. LO5

-

How are choiceboard and personalization systems used in the PizzaHut.com website?

-

Yoto Heavy Industrial uses ten units of Part No. T305 each month in the production of large diesel engines. The cost to manufacture one unit of T305 is presented below: Direct material...

-

Sherneel Ltd is an Australian company that receives design services from Gohsher Incorporated. On 18 May 2021, Sherneel Ltd received an invoice from Gobsher Incorporated amounting to US$3 million for...

-

These transactions and balances were extracted from the records of Caskets Ltd, a business that makes coffins. Additional information: 20% of wages is non-manufacturing and R36 560 of the balance is...

-

These balances were taken from the books of Parrot Elvis as at 30 September 20x6: You are required to: 1. Prepare the work-in-progress inventory account for the year ended 30 September 20x6. 2....

-

What factors should you take into account when considering using the following assets as stores of value? a. Gold b. Real estate c. Stocks d. Government bonds e. Cryptocurrencies

-

Arizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional...

-

Construct a 90% confidence interval for the population standard deviation o at Bank A. Bank A 4.2 5.4 5.9 6.1 6.6 7.7 7.7 8.6 9.3 10.0

-

Margin of Error For the poll described in Exercise 1, describe what is meant by the statement that "the margin of error was given as +3.5 percentage points."

-

1) Explain what the critical issue was in the Uber decisions in the First Circuit (Culliane case), and the Second Circuit (Myer case), and how each court, looking at the same facts, came to opposite...

-

IFRS LEASE 1. Kappa Berhad enters into a 10-year lease on 1 January 2020. Kappa Berhad incurred the following costs in respect of the lease: RM2,500 legal fees RM15,000 deposit made at the...

-

Why must employers maintain employees' individual earnings records?

-

White Bolder Investments (WBI) You are an intern working for WBI, a large investment advisory services in Sydney. Among other regular customers, WBI has been providing advisory services for Jumbo...

-

Auto Market pays $128,000 rent each year for its two-story building. The space in this building is occupied by five departments as specified here. Paint department . . . . . . . . . . . . 1,200...

-

For a recent year LOreal reported operating profit of 3,110 (in millions) for its Cosmetics division. Total assets were 11,314 at the beginning of the year and 12,988 (in millions) at the end of the...

-

Won Han Co. has four departments: materials, personnel, manufacturing, and packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect...

-

When preparing government-wide financial statements, the modified accrual based governments funds are adjusted. Please show the adjustments (in journal entry form with debits and credits) that would...

-

I need help finding the callable price and call value

-

On 31 October 2022, the owner took goods for his son as a birthday gift. The cost price of the goods was R15 000

Study smarter with the SolutionInn App