Using the information in Question 4.7, record these adjusting entries at month-end. Adjusting entries 1. Depreciate machinery

Question:

Using the information in Question 4.7, record these adjusting entries at month-end.

Adjusting entries

1. Depreciate machinery by R100.

2. Depreciate vehicles by R200.

3. Stationery unused is worth R120.

4. Materials unused are worth R210.

5. Expenses still owing for electricity and water total R160.

You are required to:

1 Draft the adjusted summary statement of financial position and statement of profit or loss & other comprehensive income.

2. Calculate the expected annual return on investment that Deep Di expects, assuming that monthly profits remain constant.

3. Comment on the output of the accounting process.

Data from Question 4.7.

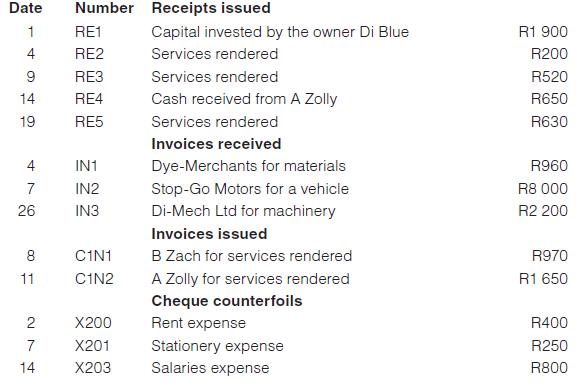

These source documents were written out during August by the accountant of Deep Di, a business engaged in dying materials and leather.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit