A company has three employees, each of whom has been employed since January 1, earns $3,000 per

Question:

a. Employees€™ Income Taxes Payable, $1,298.25 (liability for February).

b. EI Payable, $406.08 (liability for February).

c. CPP Payable, $804.36 (liability for February). d. Employees€™ Medical Insurance Payable, $1,380.00 (liability for January and February).

During March and April, the company completed the following related to payroll:

Mar.

17. Issued cheque #635 payable to the Receiver General for Canada. The cheque was in payment of the February employee income taxes, EI, and CPP amounts due.

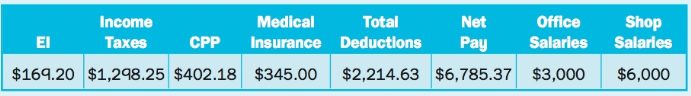

31. Prepared a general journal entry to record the March payroll register, which had the following column totals:

31. Recorded the employer€™s $345.00 liability for its 50% contribution to the medical insurance plan of employees and 6% vacation pay accrued to the employees.

31. Prepared a general journal entry to record the employer€™s payroll costs resulting from the March payroll.

Apr.

14I. ssued cheque #764 payable to the Receiver General for Canada in payment of the March mandatory deductions.

14. Issued cheque #765 payable to National Insurance Company in payment of the employee medical insurance premiums for the first quarter.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann