Access Samsungs financial statements in Appendix A. Required 1. Identify and enter the 2016 and 2017 sales

Question:

Access Samsung’s financial statements in Appendix A.

Required

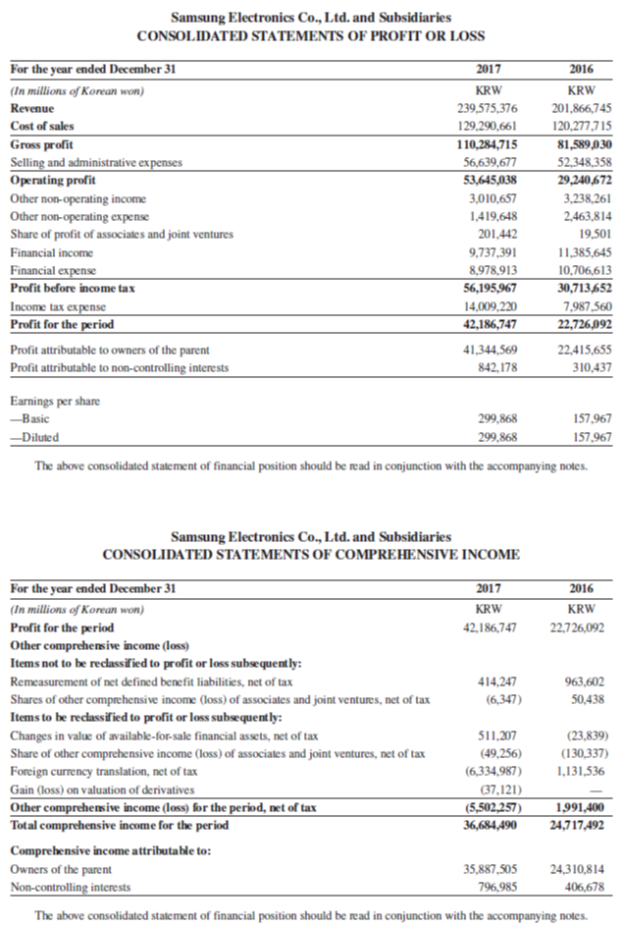

1. Identify and enter the 2016 and 2017 sales (in ₩ millions) into a table for Samsung.

2. Assume that at the end of 2016 we estimate Samsung’s 2017 sales will increase by 20% from its 2016 sales. What is Samsung’s2017 estimated sales? Round to the nearest dollar.

3. Are the estimated 2017 sales from part 2 higher or lower than Samsung’s actual 2017 sales?

Data from Samsung

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

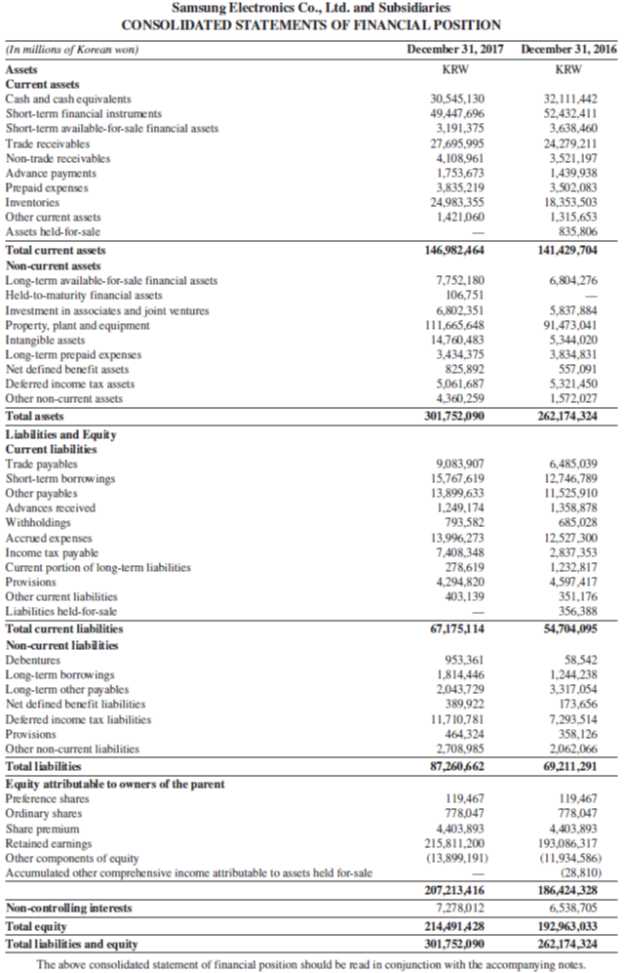

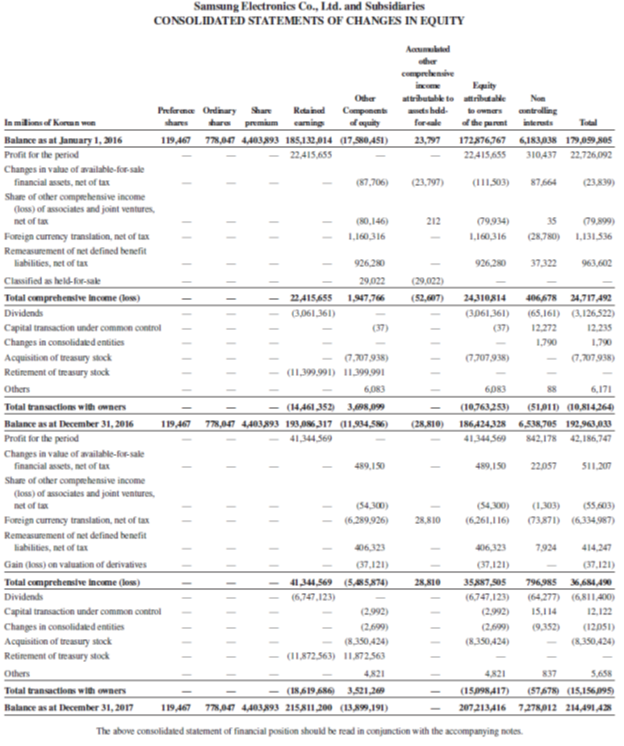

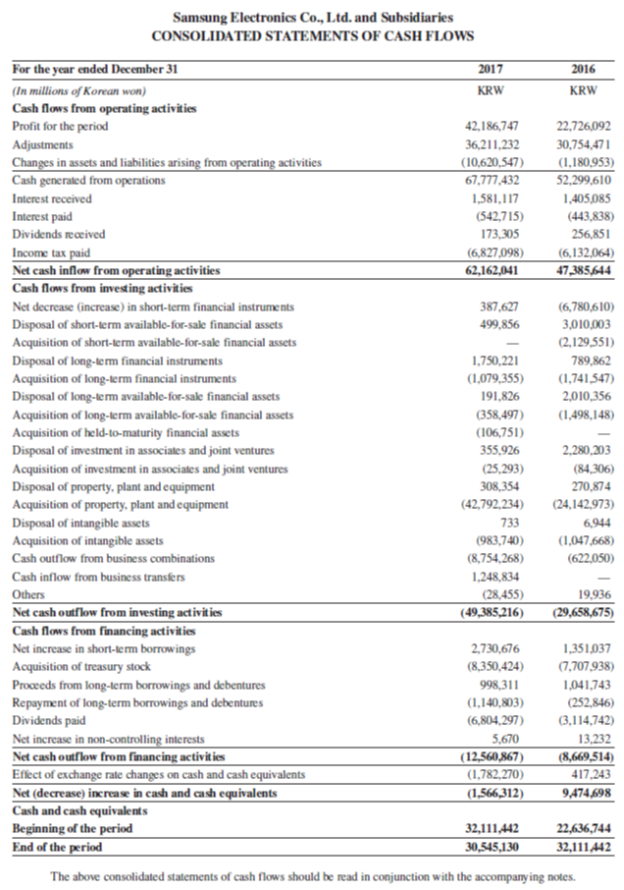

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) Assets KRW KRW Current assets 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 953,361 1,814,446 2,043,729 389,922 Long-term borrowings Long-term other payables Net defined benefit liabilities 11,710,781 464324 2,708,985 87,260,662 Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. ||||| Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS For the year ended December 31 (In millions of Korean won) 2017 2016 KRW KRW Revenue 239,575,376 201,866,745 Cost of sales 129,290,661 120,277,715 81,589 030 52,348,358 29,240672 Gross profit Selling and administrative ex penses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures 110,284,715 56,639,677 53,645,038 3,010,657 3,238,261 1,419,648 2,463,814 201,442 19,501 Financial income 9,737,391 11,385,645 Financial expense Profit before income tax Income tax expense Profit for the period 8,978,913 56,195,967 10,706,613 30,713652 14,009,220 42,186,747 7,987,560 22,726,092 Profit attributable to owners of the parent 41,344,569 22,415,655 Profit attributable to non-controlling interests 842,178 310,437 Earnings per share --Basic 299,868 157,967 -Diluted 299,868 157,967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronies Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) 2017 KRW 2016 KRW Profit for the period 42,186,747 22,726,092 Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 414,247 963,602 Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: (6,347) 50,438 511,207 (23,839) Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period (49,256) (6,334,987) (130,337) 1,131,536 (37,121) (5,502,257) 36,684,490 1,991,400 24,717,492 Comprehensive income attributable to: Owners of the parent 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Step by Step Answer:

1 and 2 Samsungs sales figures for 2016 and 2017 X data avai...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Refer to Samsung's financial statements in Appendix A. Compute its debt ratio as of December 31, 2012, and December 31, 2011.

-

Use Samsung's financial statements in Appendix A to compute its return on total assets for fiscal year ended December 31, 2012.

-

Review Samsungs financial statements in Appendix A and identify its (a) Total assets as of December 31, 2017,and December 31, 2016, (b) Operating profit for the year ended December 31, 2017. Required...

-

Suppose that two stocks whose rates of return are given by the two-factor arbitrage pricing model r= a +31 +42 r2 = 02 +241 +2, where a, and a2 are constants. Furthermore, there is a risk-free asset...

-

How much work is done by the motor in a CD player to make a CD spin, starting from rest? The CD has a diameter of 12.0 cm and a mass of 15.8 g. The laser scans at a constant tangential velocity of...

-

Consider a problem with the following goal, main criteria, and subcriteria. Assume relative importance that is most appropriate to your personal experience when ranking the main criteria and...

-

If the rate of inflation is expected to increase, would this increase or decrease the slope of the yield curve? AppendixLO1

-

At the end of 2016, Sentry Company reported a deferred tax liability of $ 6,120 based on an income tax rate of 30%. On January 2, 2017, Congress changed the income tax rate to 35%. Required: 1....

-

Curtain Co. paid dividends of $4,000; $5,000; and $8,000 during Year 1, Year 2, and Year 3, respectively. The company had 1,600 shares of 3.0%, $100 par value preferred stock outstanding that paid a...

-

Individuals who smoke have much higher rates of lung infection. Explain which first-line defenses mechanisms may be impaired by smoking, allowing pathogens to more readily enter the lower respiratory...

-

Business Solutionss second-quarter 2020 fixed budget performance report for its computer furniture operations follows. The $156,000 budgeted expenses include $108,000 in variable expenses for desks...

-

Away, as discussed in the chapter opener, uses a costing system with standard costs for direct materials,direct labor, and overhead costs. Two comments frequently are mentioned in relation to...

-

Have students read the scenario provided in the text and then conduct an instructor-led discussion using the questions provided. a. How should Demarco approach this issue when he meets with the...

-

Investigate the Mercedes Benz company and you have to cover this topic " For Business prospects, Market growth, Market quality, and Environmental aspects are three most important factors. Explain...

-

The case study for Goodwill Industries and how they "do good" as a core business strategy. What are Goodwill's competitive advantages? Goodwill has found success in social services. What problems...

-

Cosmic Cals (Pty) Ltd , a seller of personalized scientific calculators, had an inventory of 40 calculators. The value of these calculators is R15 400 each on the 1 January 2022. During the current...

-

Perform an analysis of Best Buy Co. Inc. Your analysis will draw on the Form 10K (as of February 2013). Your analysis can include information prior to February 2013 but should not draw on any...

-

Research organizational structure of a company of your choice. Use your understanding of organizational structure to analyze whether this organization's structure is the best choice for the business...

-

Solve Problem for x exactly without using a calculator. 2x 2 e x = 3xe x

-

Akramin just graduated with a Master of Engineering in Manufacturing Engineering and landed a new job in Melaka with a starting salary of RM 4,000 per month. There are a number of things that he...

-

What three factors would influence your evaluation as to whether a companys current ratio is good or bad?

-

What three factors would influence your evaluation as to whether a companys current ratio is good or bad?

-

Suggest several reasons why a 2:1 current ratio might not be adequate for a particular company.

-

Prepare journal entries to record the following events: Jul. 1 Klemens Company accepted a 5%, 3-month, $8,000 note dated July 1 from Mox Company for the balance due on Mox's account. Jul. 31 Klemens...

-

FINANCIAL STATEMENT ANALYSIS INSTRUCTIONS 1. PREPARE RATIO ANALYSIS REPORT ( word file) Format 1. Introduction 2. Importance of Financial Statements 3. Importance of Financial statement analysis and...

-

Let us assume that Europe is in recession, China's economy is slowing down, and the US economy is growing at 1-2%. Use these assumptions to invest in 4 ETFs (electronically traded funds). The 4 ETFs...

Study smarter with the SolutionInn App