Question:

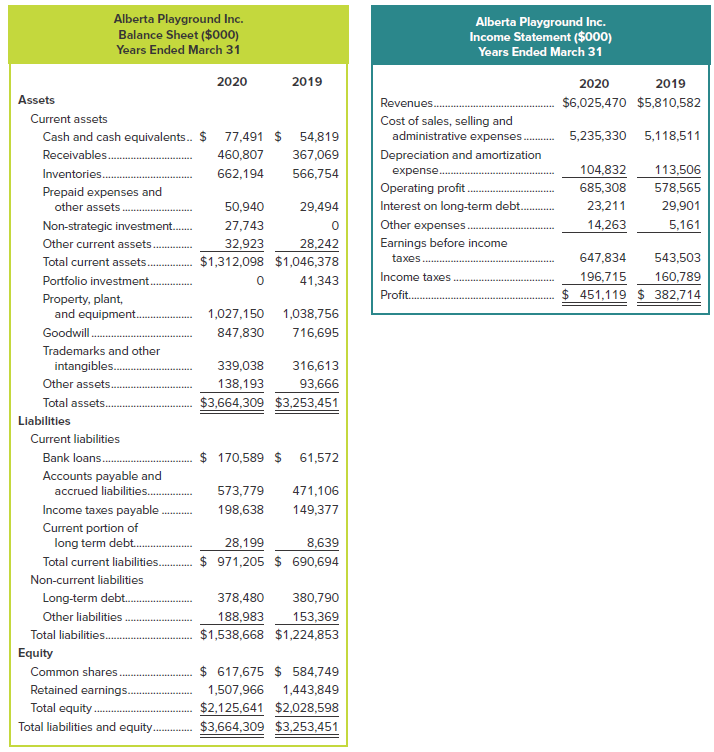

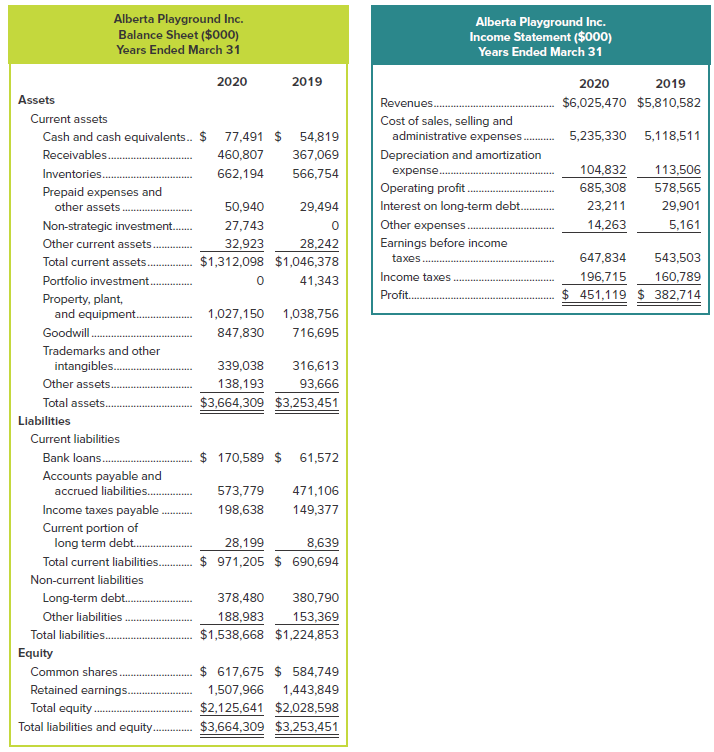

Alberta Playground Inc. produces, markets, distributes, and installs durable playground equipment. It is a new, growing playground distributor in Canada, and is hoping to expand to other provinces shortly. Its head office is in Edmonton, Alberta, and its 2020 and 2019 balance sheets and income statements follow.

Assume the common shares represent 203,830 (thousand) shares issued and outstanding for the entire year ended March 31, 2020.

Required

1. Prepare a common-size balance sheet and income statement on a comparative basis for 2020 and 2019. Identify any significant changes from 2019 to 2020. Round calculations to two decimal places.

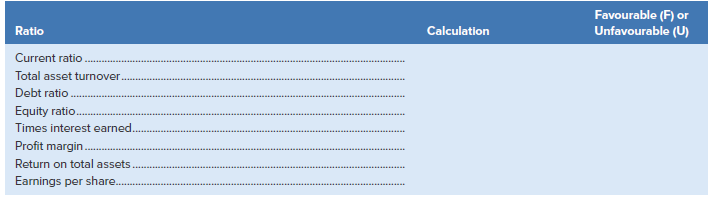

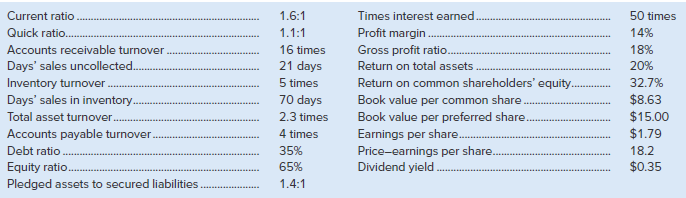

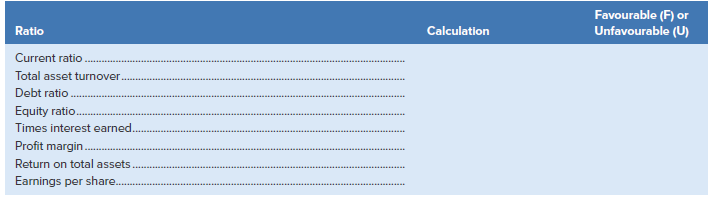

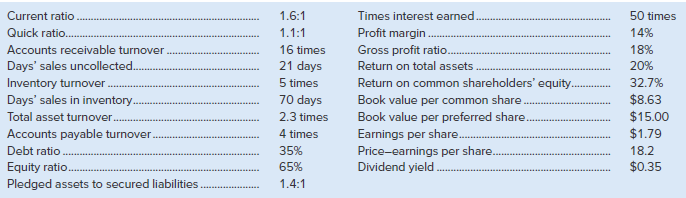

2. Calculate the 2020 ratios for Alberta Playground Inc. by completing the schedule below, including a comparison against the industry averages in Exhibit 17.11. Round calculations to two decimal places.

Exhibit 17.11

Transcribed Image Text:

Alberta Playground Inc. Balance Sheet ($000) Years Ended March 31 Alberta Playground Inc. Income Statement ($000) Years Ended March 31 2020 2019 2019 2020 Revenues. Assets $6,025,470 $5,810,582 Current assets Cost of sales, selling and Cash and cash equivalents. $ 77,491 $ 54,819 administrative expenses. 5,235,330 5,118,511 367,069 Receivables. 460,807 Depreciation and amortization 104,832 113,506 expense. Inventories. 662,194 566,754 Operating profit. 685,308 578,565 Prepaid expenses and other assets. Interest on long-term debt. Other expenses. 23,211 29,901 50,940 29,494 27,743 14,263 5,161 Non-strategic investment. Earnings before income Other current assets. 32,923 28,242 647,834 543,503 Total current assets.. taxes $1,312,098 $1,046,378 Income taxes 196,715 160,789 Portfolio investment. 41,343 $ 451,119 $ 382,714 Profit. Property, plant, and equipment. 1,027,150 1,038,756 847,830 Goodwill. 716,695 Trademarks and other 316,613 intangibles. 339,038 Other assets.. 138,193 93,666 Total assets. $3,664,309 $3,253,451 Liabilities Current liabilities $ 170,589 $ 61,572 Bank loans. Accounts payable and accrued liabilities. 471,106 573,779 Income taxes payable. 198,638 149,377 Current portion of long term debt. Total current liabilities. 8,639 $ 971,205 $ 690,694 28,199 Non-current liabilities Long-term debt. 378,480 380,790 Other liabilities 153,369 $1,538,668 $1,224,853 188,983 Total liabilities. Equity $ 617,675 $ 584,749 Common shares Retained earnings. Total equity. 1,507,966 1,443,849 $2,125,641 $2,028,598 Total liabilities and equity. $3,664,309 $3,253,451 Favourable (F) or Unfavourable (U) Calculation Ratio Current ratio Total asset turnover Debt ratio Equity ratio. Times interest earned. Profit margin. Return on total assets Earnings per share.