Apple offers extended service contracts that provide repair coverage for its products. Assume Apple charges$160 to repair

Question:

Apple offers extended service contracts that provide repair coverage for its products. Assume Apple charges$160 to repair an iPhone screen and $400 for other repairs. Services are provided in a ratio of 2 screens to 1 other repair(2:1). Variable costs are 40% of selling price for iPhone screen repairs and 48% of selling price for other repairs. Assume fixed costs are $2 billion per year for the repair services department.

Required

1. Compute the selling price per composite unit for Apple’s repair services.

2. Compute the variable cost per composite unit for Apple’s repair services.

3. How many composite units must Apple’s repair services department sell each year to break even?

4. At the break-even level, how many screen repairs and other repairs will Apple complete each year?

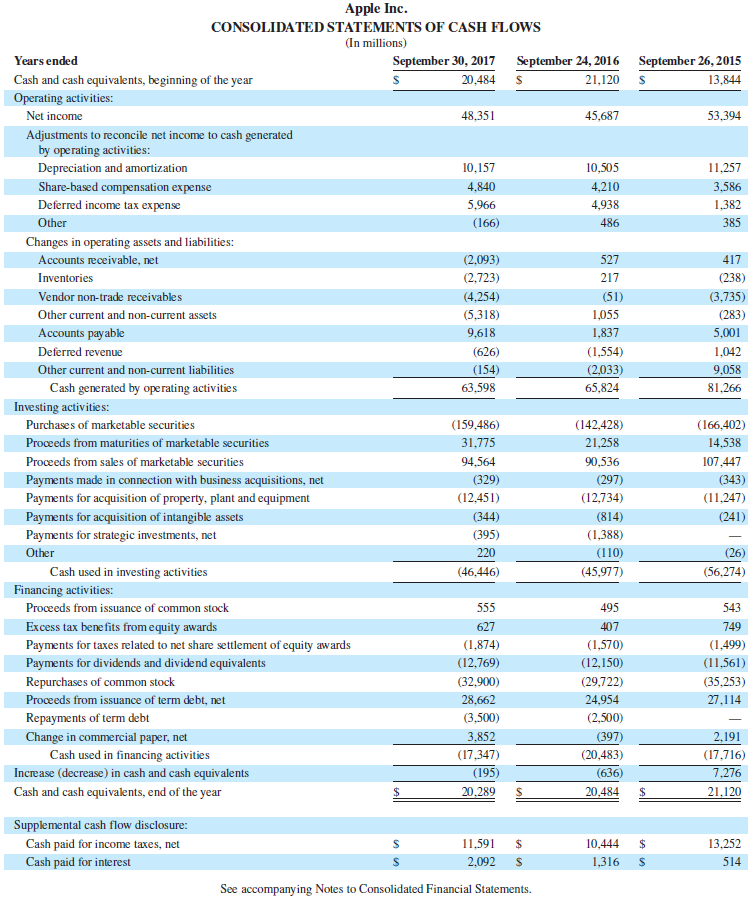

Data from Apple’s

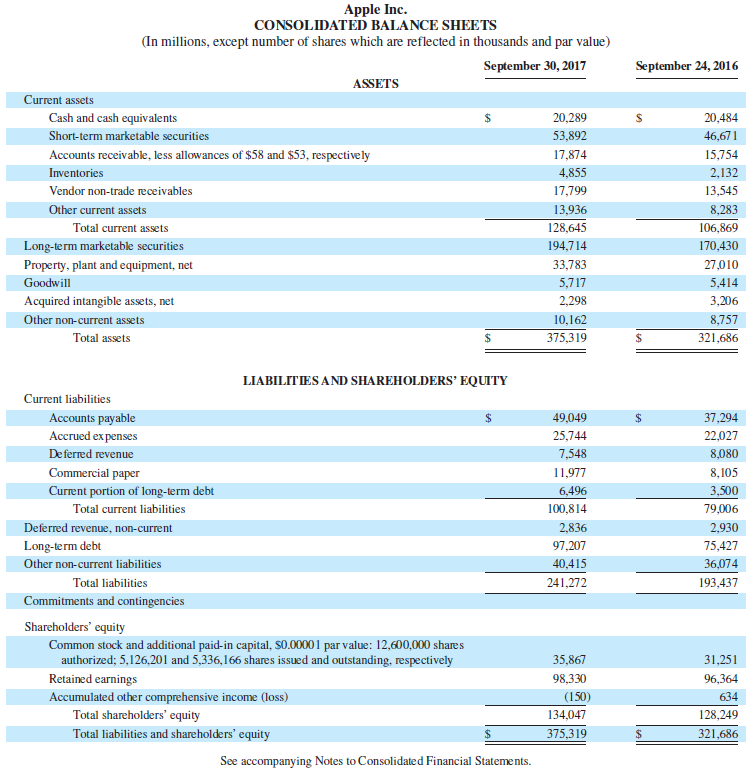

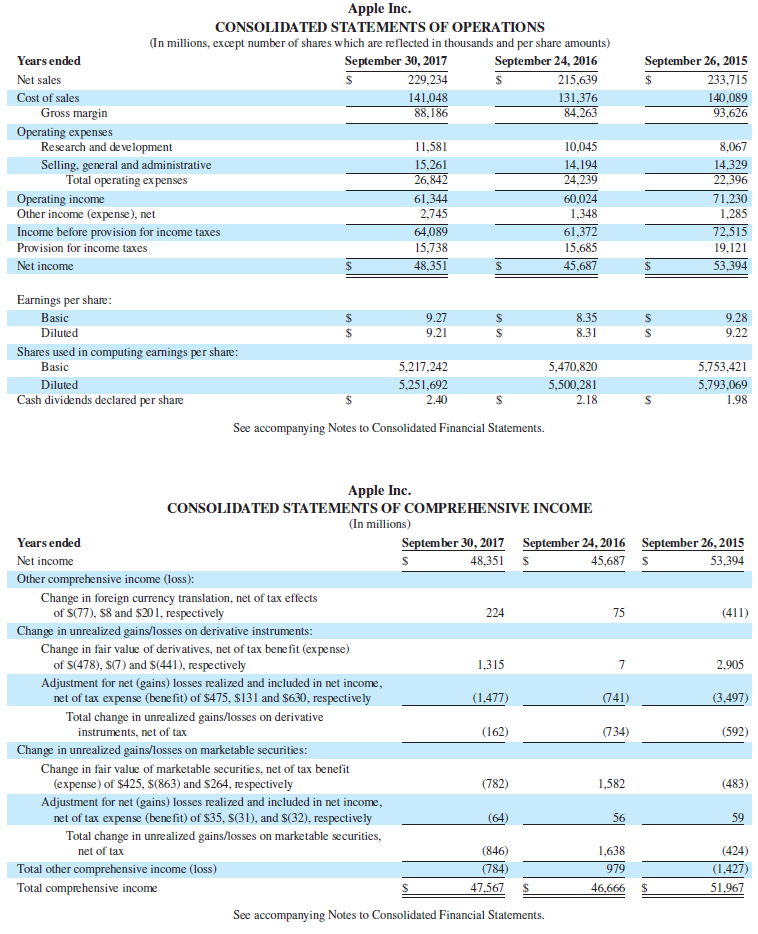

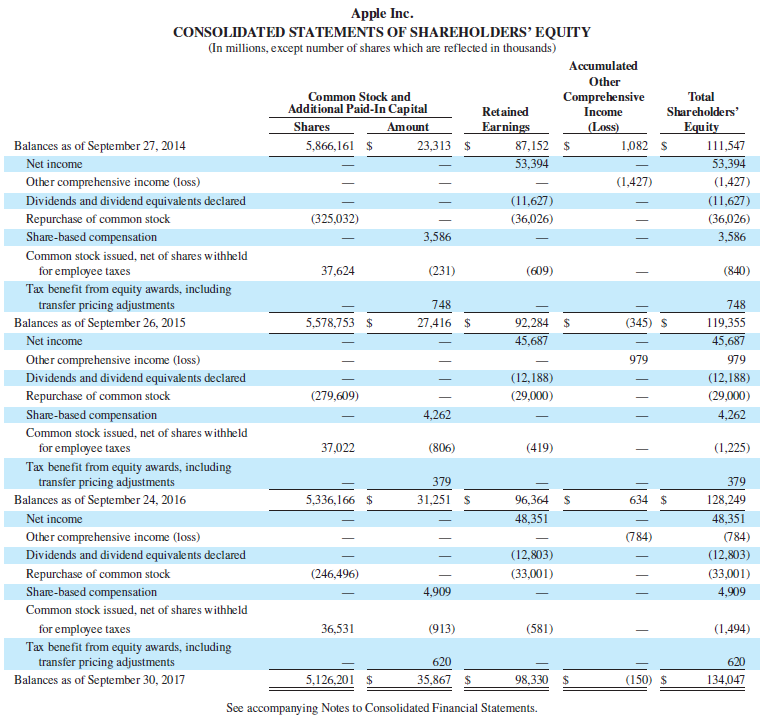

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 24, 2016 September 30, 2017 ASSETS Current assets 24 20,484 Cash and cash equivalents 20,289 53,892 Short-term marketable securities 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 128,645 Total current assets 106,869 170,430 Long-term marketable securities 194,714 Property, plant and equipment, net 33,783 27,010 Goodwill 5,717 5,414 2.298 Acquired intangible assets, net 3,206 Other non-current assets 10,162 8,757 375,319 Total assets 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 37,294 Accounts payable Accrued ex penses 49,049 25,744 22,027 7,548 De ferred revenue 8,080 Commercial paper 11,977 8,105 Current portion of long-term debt 6,496 3,500 100,814 Total current liabilities 79,006 Deferred revenue, non-current 2,836 2,930 97,207 Long-term debt 75,427 Other non-current liabilities 40,415 36,074 193,437 Total liabilities 241,272 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, S0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings 35,867 31,251 98,330 96,364 Accumulated other comprehensive income (loss) Total shareholders' equity (150) 634 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 30, 2017 September 24, 2016 September 26, 2015 Net sales 229,234 215,639 24 233,715 Cost of sales 141,048 131,376 84,263 140,089 93,626 Gross margin 88,186 Operating expenses Research and development 11,581 10,045 8,067 Selling, general and administrative Total operating ex penses 15,261 26,842 14,194 24,239 14,329 22.396 Operating income Other income (expense), net 60,024 1,348 71,230 61,344 2,745 1,285 Income before provision for income taxes 64,089 61,372 72,515 Provision for income taxes 15,738 15,685 19,121 Net income 48,351 45,687 53,394 Earnings per share: Basic Diluted %24 9.27 8.35 %24 9.28 9.21 8.31 9.22 Shares used in computing earnings per share: Basic 5,217,242 5,470,820 5,753,421 Diluted 5,251,692 5,500,281 5,793,069 Cash dividends declared per share 2.40 2.18 1.98 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 30, 2017 September 24, 2016 September 26, 2015 Years ended Net income 48,351 45,687 S 53,394 Other comprehensive income (loss): Change in foreign currency translation, net of tax effects of S(77), $8 and $201, respectively 224 75 (411) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit (expense) of S(478), $(7) and $(441), respectively 1,315 2,905 Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $475, $131 and $630, respective ly Total change in unrealized gains/losses on derivative instruments, net of tax (1,477) (741) (3,497) (162) (734) (592) Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit (expense) of $425, $(863) and $264, respectively (782) 1,582 (483) Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $35, S(31), and $(32), respectively Total change in unrealized gains/losses on marketable securities, net of tax (64) 56 59 (846) 1,638 (424) Total other comprehensive income (loss) (784) 979 (1,427 Total comprehensive income 47,567 46,666 51,967 See accompanying Notes to Consolidated Financial Statements.

Step by Step Answer:

1 Selling price per composite unit 2 screens 160 per unit 320 1 other ...View the full answer

Students also viewed these Business questions

-

Render Co. CPA is preparing activity-based budgets for 2019. The partners expect the firm to generate billable hours forthe year as follows. The company pays $15 per hour to data-entry clerks, $30...

-

On January 1, 2019, when the market rate for bond interest was 14%, Lenoir Corporation issued bonds in the face amount of $500,000 with interest at 12% payable semiannually. The bonds mature on...

-

An examination of the accounting records of Durham Corporation on January 1, 2019 (after reversing entries had been made for all accrued interest at the end of 2018) disclosed the following...

-

On January 2, 2013, Parker Corporation invests in the stock of Quarry Corporation. Quarry's book value is $4 million and its assets and liabilities are fairly reported. Quarry reports income of $3...

-

A marble column with a cross-sectional area of 25 cm2 supports a load of 7.0 104 N. The marble has a Young's modulus of 6.0 1010 Pa and a compressive strength of 2.0 108 Pa? (a) What is the stress...

-

Identify three methods of depreciating non-current assets.

-

How are sales taxes recorded in the context of special journals? AppendixLO1

-

The following changes in account balances and other information for 2007 were taken from the accounting records of the Noble Company: Other information: Net income was $9,900. Dividends were declared...

-

36 39 42 45 == 48 The annual rate of return method is based on OA) cash flow data. O B) market values. O D) the time value of money data. D) accounting data. Question 39 (5-points) Listen

-

Use Theorem 5.2.1 to determine which of the following are subspaces of Mnn. (a) All n x n matrices A such that AT = -A (b) All n x n matrices A such that the linear system Ax = 0 has only the trivial...

-

Rivera Co. sold 20,000 units of its only product and incurred a $50,000 loss (ignoring taxes) for the current year, as shown here. During a planning session for year 2020s activities, the production...

-

Both Apple and Google sell electronic devices, and each of these companies has a different product mix.Assume the following data are available for both companies. Required 1. Compute each companys...

-

What are the differences between job satisfaction, organizational commitment, employee engagement, and organizational citizenship?

-

How would you explain the following code in plain English? boxplot(age ~ gender, data = donors) Question 8 options: Make a boxplot comparing gender grouped by age, using the donors dataset Make two...

-

Vision Consulting Inc. began operations on January 1, 2019. Its adjusted trial balance at December 31, 2020 and 2021 is shown below. Other information regarding Vision Consulting Inc. and its...

-

A Jeans maker is designing a new line of jeans called Slams. Slams will sell for $290 per unit and cost $182.70 per unit In variable costs to make. Fixed costs total $68,500. (Round your answers to 2...

-

NAME: Week Two Define Claim in your own words Explain the difference between a discussion and an argument. Summarize the characteristics of a claim (Listing is not summarizing) Define Status Quo in...

-

1.How do you think major stores such as Walmart will change in the future under this new retail renaissance? 2.What are some changes that you would suggest in traditional retail stores to attract...

-

From the dawn of humanity to 1830, world population grew to one billion people. In 100 more years (by 1930) it grew to two billion, and 3 billion more were added in only 60 years (by 1990). In 2016,...

-

(a) Given a mean free path = 0.4 nm and a mean speed vav = 1.17 105 m/s for the current flow in copper at a temperature of 300 K, calculate the classical value for the resistivity of copper. (b)...

-

What are the three categories of manufacturing costs?

-

What are the three categories of manufacturing costs?

-

List several examples of factory overhead.

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

-

NEED THIS EXCEL TABLE ASAP PLEASE!!!! Presupuesto Operacional y C lculo del COGS Ventas Proyectadas: Ventas Proyectadas: $ 4 5 0 , 0 0 0 Precio por unidad: $ 4 5 0 Unidades vendidas: 4 5 0 , 0 0 0 4...

-

The wash sale rules apply to disallow a loss on a sale of securities_______? Only when the taxpayer acquires substantially identical securities within 30 days before the sale Only when the taxpayer...

Study smarter with the SolutionInn App