Barry Bowtie incorporated his business under the name BowTie Fishing Expeditions Corp. on March 1, 2020. It

Question:

Barry Bowtie incorporated his business under the name BowTie Fishing Expeditions Corp. on March 1, 2020. It was authorized to issue 30,000 $2 cumulative preferred shares and an unlimited number of common shares. During March, the following equity transactions occurred:

a. 50,000 common shares were issued for cash of $3 per share.

b. 10,000 preferred shares were issued for $5,000 cash plus equipment with a fair market value of $37,000.

c. The corporation reported profit for the month of $190,000.

d. Total cash dividends of $45,000 were declared payable on April 15 to shareholders of record on March 31.

Required

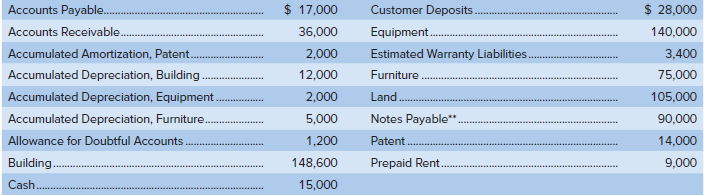

Using the information provided in (a) through (d) plus the following March 31, 2020, selected account balances,* prepare the statement of changes in equity for the month ended March 31, 2020, along with the March 31, 2020, balance sheet:

Analysis Component: Use your financial statements prepared above to answer each of the following questions (round percentages to the nearest whole percent):

1. What percentage of the total assets is equity financed?

2. What percentage of the total assets is financed by debt?

3. Assume that 30% of BowTie Fishing (the previous proprietorship) was financed by debt at March 31, 2019. Has the risk associated with debt financing increased or decreased from 2019 to 2020? Explain.

4. What percentage of the total assets is owned by the common shareholders?

5. What percentage of the assets is financed by the preferred shareholders?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann