Battistella Couture & Design Co. began operations in 2021. During January 2021, the company had the following

Question:

Battistella Couture & Design Co. began operations in 2021. During January 2021, the company had the following transactions:

Jan. 2 Paid January rent, $525.

4 Finished sewing a suit, delivered it to the customer, and collected $1,055 cash.

5 Purchased supplies for $420 on account.

7 Received an order from another customer to design and sew a leather jacket for $1,085.

10 Agreed to sew a wedding dress for a customer for $3,000. Received $1,500 cash from the customer as a down payment.

12 The owner, Karen Battistella, withdrew $500 cash for personal use.

18 Finished sewing the leather jacket (see January 7 transaction), and delivered it to the customer.

The customer, a friend of Karen?s, asked if she could pay at the end of the month. Karen agreed.

25 Paid for the supplies purchased on January 5.

27 The customer billed on January 18 paid the amount owing.

28 Borrowed $5,000 cash from the bank and signed a one-year, 5% note payable.

29 Used $1,950 of the note payable to purchase a new pressing machine.

Instructions

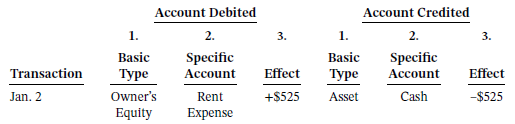

a. For each transaction, indicate: (1) the basic type of account debited and credited (asset, liability, or owner?s equity); (2) the specific account debited and credited (Cash, Rent Expense, Service Revenue, etc.); and (3) whether each account is increased (+) or decreased (?), and by what amount. Use the following format, in which the fi rst transaction is given as an example:

b. Prepare a journal entry for each transaction.

Taking it further

Karen is confused about why credits are used to decrease cash. Explain.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak