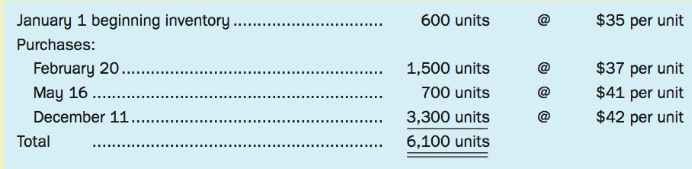

During 2017, Fresh Express Company sold 2,500 units of its product on September 20 and 3,000 units

Question:

Required

Prepare a comparative income statement for the company, showing in adjacent columns the profits earned from the sale of the product, assuming the company uses a perpetual inventory system and prices its ending inventory on the basis of:

a. FIFO

b. Moving weighted average cost. Round all unit costs to two decimal places.

Analysis Component: If the manager of Fresh Express Company earns a bonus based on a percentage of gross profit, which method of inventory costing will she prefer?

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: