Fab-Form Industries completed the following transactions involving the purchase of delivery equipment. Required Prepare journal entries to

Question:

Fab-Form Industries completed the following transactions involving the purchase of delivery equipment.

Required

Prepare journal entries to record the transactions.

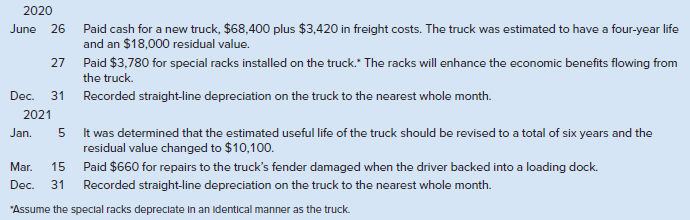

2020 Paid cash for a new truck, $68,400 plus $3,420 in freight costs. The truck was estimated to have a four-year life and an $18,000 residual value. 27 Paid $3,780 for special racks installed on the truck." The racks will enhance the economic benefits flowing from the truck. Recorded straight-line depreciation on the truck to the nearest whole month. 26 June Dec. 31 2021 Jan. It was determined that the estimated useful life of the truck should be revised to a total of six years and the residual value changed to $10,100. Paid $660 for repairs to the truck's fender damaged when the driver backed into a loading dock. Mar. 15 Recorded straight-line depreciation on the truck to the nearest whole month. Dec. "Assume the speclal racks depreclate In an identical manner as the truck. LO

Step by Step Answer:

2020 June 26 Truck 71820 Cash 71820 To record purchase of ...View the full answer

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Business questions

-

South Seas Distributors completed the following transactions involving the purchase and operation of a delivery truck: 2015 Transaction Description May 27 Paid $35,600 for a new truck. It was...

-

South Seas Distributors completed the following transactions involving the purchase and operation of a delivery truck: 2011 Transaction Description May 27 Paid $35,600 for a new truck, plus $4,272 in...

-

Photon Control completed the following transactions involving delivery trucks: Required Prepare journal entries to record thetransactions. 2014 Mar 26 Paid cash for a new delivery truck, $97,075 plus...

-

make a stored procedure called projects_at_this_location that receives a location and returns the projects (if any) at that location as shown in the following sample run: (2 points) exec...

-

What are the extra costs incurred by the creation and scheduling of a process, as compared to the cost of a cloned thread?

-

What steps should SNC-Lavalin and other companies in this situation take to minimize these types of corporate wrongdoing?

-

Identify criteria for choosing a leadership style.

-

Czyz and Ng are accountants at Kwick Kopy Printers. Kwick Kopy has not adopted the revaluation model for accounting for its property, plant, and equipment. The accountants are having disagreements...

-

Michael Inc., which produces a single product, has prepared the following standard cost sheet for one unit of the product. Direct materials ( 6 pounds at $ 1.60 per pound) $ 9.60 Direct labor ( 3...

-

Which of the graphs in Fig. Q25.12 best illustrates the current I in a real resistor as a function of the potential difference V across it? Explain. Figure Q25.12 (a) (b) (c) (d)

-

Kenartha Oil recently paid $483,900 for equipment that will last five years and have a residual value of $114,000. By using the machine in its operations for five years, the company expects to earn...

-

Refer to the information in QS 9-10. Assume the equipment is depreciated using the double-declining-balance method. Calculate depreciation for 2020 and 2021: a. To the nearest whole month b. Using...

-

Why do companies offer a cash discount?

-

Questions for scen ario one Why do you think you feel uncomfortable about this new situation? Could you have avoided this situation in the first place? What is the best course of action you can take?...

-

Draw a current state map of Ford Manufacturing (One family/ product/service flow). Give a brief explanation of the current state and the related issues with it. create your own action plan to show...

-

THE SHRM Learning system provides several motivation theories that increase engagement. Which of the motivation theories most aligns your real world experience as personally motivating you and why?...

-

Leadership and management are two distinct yet complementary concepts within organizations. Leadership is about inspiring and influencing others towards a shared vision or goal, often focusing on...

-

Analyse the need and want(s) that led you to research products or services that would address the state of your imbalance. 2. Examine the internal and external sources of information by including...

-

Findlay Instruments produces a complete line of medical instruments used by plastic surgeons and has experienced rapid growth over the past 5 years. In an effort to make more accurate predictions of...

-

When you weigh yourself on good old terra firma (solid ground), your weight is 142 lb. In an elevator your apparent weight is 121 lb. What are the direction and magnitude of the elevator's...

-

One-half of the adjusting entry is given below. Indicate the account title for the other half of the entry. (a) Salaries Expense is debited. (b) Depreciation Expense is debited. (c) Interest Payable...

-

One-half of the adjusting entry is given below. Indicate the account title for the other half of the entry. (a) Salaries Expense is debited. (b) Depreciation Expense is debited. (c) Interest Payable...

-

Why is it possible to prepare financial statements directly from an adjusted trial balance?

-

The yield to maturity is not the compound annual rate of return earned on a debt security purchased on a given day and held to maturity. true or false

-

If 1500 is deposited at the end of each quarter in an account that earns 4% compounded quarterly, after how many quarters will the account contain 60,000? (round your answer up to the nearest quarter)

-

With a 35 percent marginal tax rate, would a tax-free yield of 6.1 percent or a taxable yield of 10 percent give you a better return on your savings?

Study smarter with the SolutionInn App