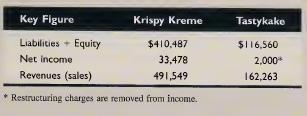

Key comparative figures ($ thousands) for both Krispy Kreme and Tastykake follow: Required 1. What is the

Question:

Key comparative figures ($ thousands) for both Krispy Kreme and Tastykake follow:

Required

1. What is the total amount of assets invested in

(a) Krispy Kreme and (b) Tastykake?

2. What is the return on assets for (a) Krispy Kreme and (b) Tastykake? Krispy Kreme’s beginning year assets equal \($255,376\) (in thousands) and Tastykake’s beginning-year assets equal \($116,137\) (in thousands).

3. How much are expenses for

(a) Krispy Kreme and (b) Tastykake?

4. Is return on assets satisfactory for

(a) Krispy Kreme and (b) Tastykake? (Assume competitors average a 3% return.)

5. What can you conclude about Krispy Kreme and Tastykake from these computations?

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta