Loblaw Companies Limited, headquartered in Toronto, Ontario, is a large food and pharmacy retailer. Loblaw?s authorized share

Question:

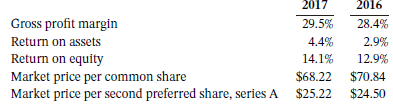

Loblaw Companies Limited, headquartered in Toronto, Ontario, is a large food and pharmacy retailer. Loblaw?s authorized share capital includes an unlimited number of common shares, 1 million first preferred shares, and an unlimited number of second preferred shares. As at December 30, 2017, no first preferred shares had ever been issued. The following information is also available for the years ended December 30, 2017, and December 31, 2016:

Instructions

a. Discuss the change in Loblaw?s profitability from 2016 to 2017.

b. Is your assessment in part (a) consistent with the change in market price per share? Explain.

c. Loblaw issued 1,019,610 common shares during 2017 and received proceeds of $41 million, but no additional preferred shares were issued during 2017. Was it more advantageous to issue the common shares instead of preferred shares? Explain.

d. Loblaw has a stock option plan for its employees and directors. What advantages are there to the employees when they receive a portion of their annual compensation in shares? What are the advantages to the corporation?

e. The preferred shareholders receive a dividend of 5.30% on the face value of the preferred shares. The company has issued a total of 9 million second preferred shares, series B, with total face value of $225 million. What is the dollar amount of the dividend per share? Why is this rate higher than the interest rate on savings accounts paid by banks?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak