McTavish Ltd. completed its fi rst year of operations on September 30, 2021. McTavish reported the following

Question:

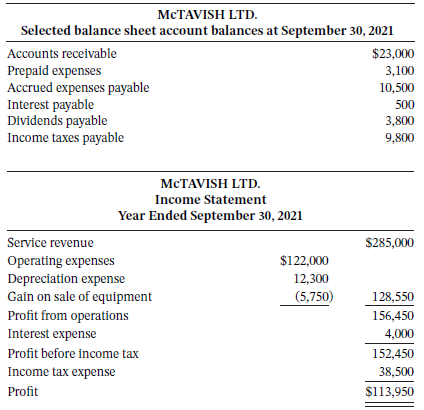

McTavish Ltd. completed its fi rst year of operations on September 30, 2021. McTavish reported the following information at September 30, 2021:

Instructions

Assuming that McTavish reports under ASPE, prepare the operating section of a cash fl ow statement using the direct method.

Transcribed Image Text:

MCTAVISH LTD. Selected balance sheet account balances at September 30, 2021 Accounts receivable $23,000 Prepaid expenses Accrued expenses payable Interest payable Dividends payable Income taxes payable 3,100 10,500 500 3,800 9,800 MCTAVISH LTD. Income Statement Year Ended September 30, 2021 Service revenue $285,000 $122,000 Operating expenses Depreciation expense Gain on sale of equipment 12,300 (5,750) 128,550 Profit from operations Interest expense 156,450 4,000 Profit before income tax 152,450 Income tax expense 38,500 Profit $113,950

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 64% (14 reviews)

McTAVISH LTD Cash Flow Statement partial x Direct Method Year Ended September 30 2021 Operating acti...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Students also viewed these Business questions

-

McTavish Ltd. completed its first year of operations on September 30, 2014. McTavish reported the following information at September 30, 2014: McTAVISH LTD. Selected balance sheet account balances at...

-

McTavish Ltd. completed its first year of operations on September 30, 2017. McTavish reported the following information at September 30, 2017: McTAVISH LTD. Selected balance sheet account balances at...

-

Hammond Ltd. completed its first year of operations on September 30, 2014. Hammond reported the following information at September 30, 2014: HAMMOND LTD. Selected balance sheet account balances at...

-

Given that a quantity Q(t) is described by the exponential growth function Q(t) = 400e0.01t where t is measured in minutes, answer the following questions. (a) What is the growth constant k? k = (b)...

-

If the probability that a normal object is classified as an anomaly is 0.01 and the probability that an anomalous object is classified as anomalous is 0.99, then what is the false alarm rate and...

-

What ecological issues are involved in this case?

-

The following Cash T-account summarizes all the transactions affecting cash during 1997 for Miller Manufacturing. Cash Beginning balance 9,000 Equipment purchases 24,000 Sales of services 45,000 Rent...

-

Claytonhill Beverages Ltd. is 100 percent owned by Buzz Bottling. While the company has in the past been profitable, it incurred a loss for the year ended December 31, 2012. The parent company, Buzz...

-

what do we mean when we say "capturing the voice of costumer"

-

Telco Ltd. is a Danish telecom company that prepares consolidated financial statements in full compliance with IFRS 10. The company has expanded dramatically in Central Asia in recent years by...

-

Home Grocery Corporation reported the following in its 2021 financial statements. Calculate the cash payments for income tax. 2021 2020 Income tax payable Income tax expense $17,000 90,000 $8,000

-

ICE Inc. reported the following in its December 31, 2021, financial statements. Calculate the cash payments to employees. 2021 2020 Salaries payable Salaries expense $ 2,500 $4,000 188,000

-

Why would a manager use discounted payback period? Can the discounted payback ever be longer than the conventional payback?

-

Sunland Corp. exchanged Building 24, which has an appraised value of $1,815,000, a cost of $2,842,000, and accumulated depreciation of $1,272,000, for Building M which belongs to Oriole Ltd. Building...

-

Conlon Chemicals manufactures paint thinner. Information on the work in process follows: -Beginning Inventory, 43,000 partially complete gallons -Transferred out, 211300 gallons -Ending inventory...

-

Mr . Nikola Tesla launched Tesla Supermart on December 1 , 2 0 x 1 with a cash investment of 1 5 0 , 0 0 0 . The following are additional transactions for the month: 2 Equipment valued at 2 0 , 0...

-

The Robots: Stealing Our Jobs or Solving Labour Shortages? As the coronavirus pandemic enveloped the world, businesses increasingly turned to automation in order to address rapidly changing...

-

Aquazona Pool Company is a custom pool builder. The company recently completed a pool for the Drayna family ( Job 1 3 2 4 ) as summarized on the incomplete job cost sheet below. Assume the company...

-

The Sacramento plant of Montero Food Corporation produces a gourmet cheese. The following data pertain to the year ended December 31, 2020: During the year, the company started 200,000 pounds of...

-

In your audit of Garza Company, you find that a physical inventory on December 31, 2012, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items...

-

Diamond Dealers has two notes payable outstanding on December 31, 2021, as follows: a. A five-year, 5.5%, $60,000 note payable issued on August 31, 2021. Diamond Dealers is required to pay $12,000...

-

Slovak Plumbing Company pays its support staff weekly and its plumbers on a semimonthly basis. The following support staff payroll information is available for the week ended May 12, 2018: The...

-

Steigs Sports Store has a customer loyalty program in which it issues points to customers for every cash purchase that can be applied to future purchases. For every dollar spent, a customer receives...

-

The principal amount of a bond is $65,000 its stated rate is 7%, and the term of the bond is 6 years. The bond pays interest semiannually. At the time of issue, the market rate is 8%. Determine the...

-

4) You make a deposit of $780 at 6% interest compounded annually. How much will be in the account in 3 years

-

This is the solved part A. Just need help in solving the next questions from 1-6. These four pages are interconnected one by one as i posted. First part was solved as I uploaded the picture...

Study smarter with the SolutionInn App