On December 31, 2020, RCA Company?s Allowance for Doubtful Accounts had an unadjusted debit balance of $7,800.

Question:

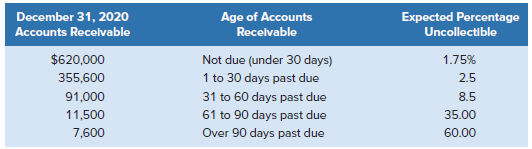

On December 31, 2020, RCA Company?s Allowance for Doubtful Accounts had an unadjusted debit balance of $7,800. The accountant for RCA has prepared a schedule of the December 31, 2020, accounts receivable by age and, on the basis of past experience, has estimated the percentage of the receivables in each age category that will become uncollectible. This information is summarized as follows:

Required

1. Calculate the amount that should appear in the December 31, 2020, balance sheet as the Allowance for Doubtful Accounts.

2. Prepare the journal entry to record bad debt expense for 2020.

Analysis Component: On July 31, 2021, RCA concluded that a customer?s $4,200 receivable (created in 2020) was uncollectible and that the account should be written off. What effect will this action have on RCA?s 2021 profit? Explain your answer.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann