On January 1, 2021, Ponasis Corporation issued $2.5-million, 10-year bonds. The bonds pay semi-annual interest on July

Question:

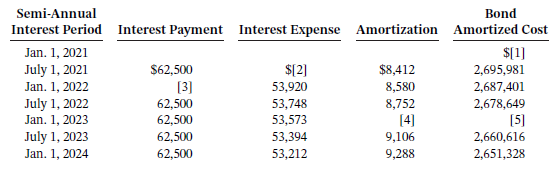

On January 1, 2021, Ponasis Corporation issued $2.5-million, 10-year bonds. The bonds pay semi-annual interest on July 1 and January 1, and Ponasis has a December 31 year end. Presented below is a partial amortization schedule.

Instructions

a. Were the bonds issued at a discount or a premium?

b. What is the face value of the bonds?

c. What is the contractual rate of interest?

d. Fill in the missing amounts for items [1] through [5].

e. What was the market interest rate when the bonds were issued?

f. Record the issue of the bonds on January 1, 2021.

g. Record the interest payment on July 1, 2021.

h. Record the accrual of interest on December 31, 2021.

i. What amounts would be reported as current and non-current in the liabilities section of Ponasis?s December 31, 2021, balance sheet?

Taking It Further

Why would Ponasis?s board of directors not have set the contractual interest rate at the market interest rate on the date of issue when it authorized the bond issue?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak