On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a

Question:

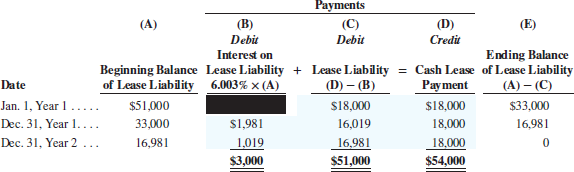

On January 1, Rogers (lessee) signs a three-year lease for machinery that is accounted for as a finance lease. The lease requires three $18,000 lease payments (the first at the beginning of the lease and the remaining two at December 31 of Year 1 and Year 2). The present value of the three annual lease payments is $51,000, using a 6.003% interest rate. The lease payment schedule follows.

Required

1. Prepare the January 1 journal entry at the start of the lease to record any asset or liability.

2. Prepare the January 1 journal entry to record the first $18,000 cash lease payment.

3. Prepare the December 31 journal entry to record straight-line amortization with zero salvage value at the end of

(a) Year 1,

(b)Year 2,

(c) Year 3.

4. Prepare the December 31 journal entry to record the $18,000 cash lease payment at the end of (a) Year 1 and (b) Year 2.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer: