Refer to Appendix A and locate Apples balance sheet. What is the total of Apples 2017 accounts

Question:

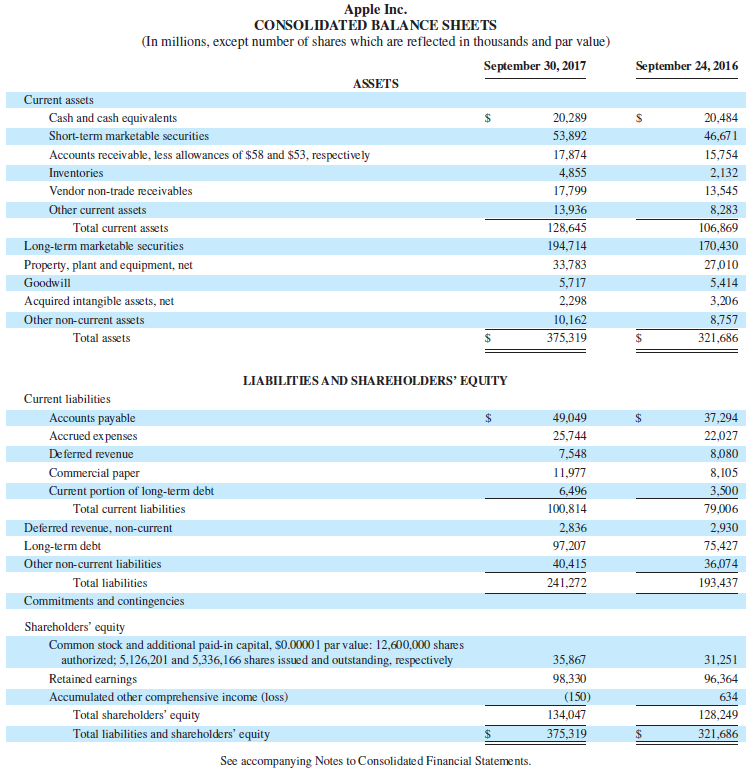

Refer to Appendix A and locate Apple’s balance sheet. What is the total of Apple’s 2017 accounts payable? What is the total of its schedule of accounts payable?

Refer to Appendix A

Transcribed Image Text:

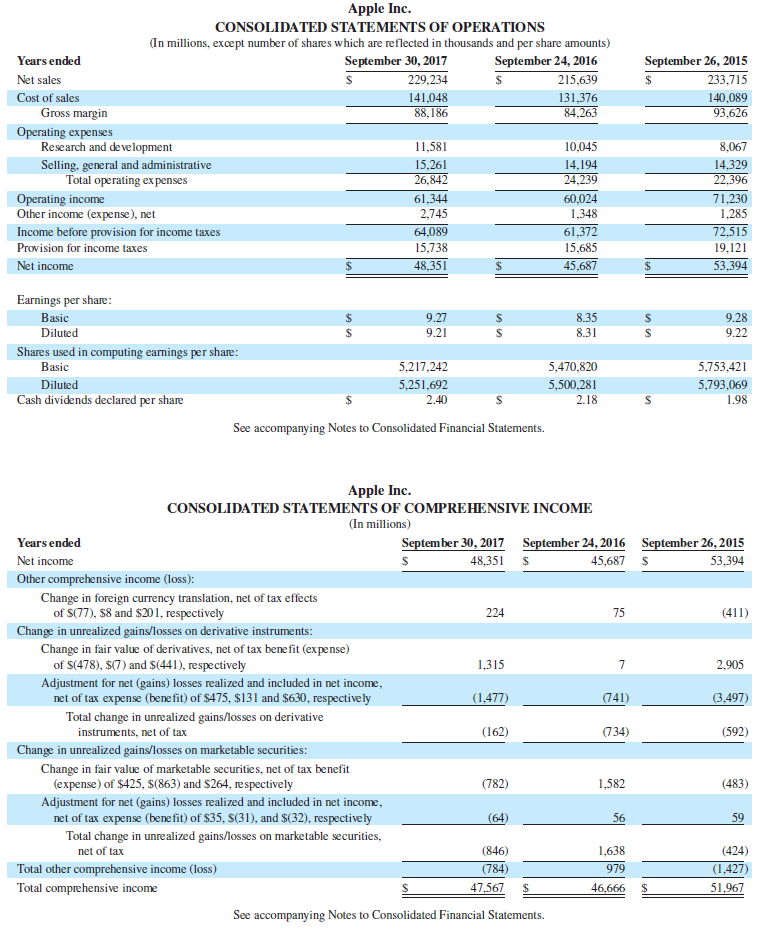

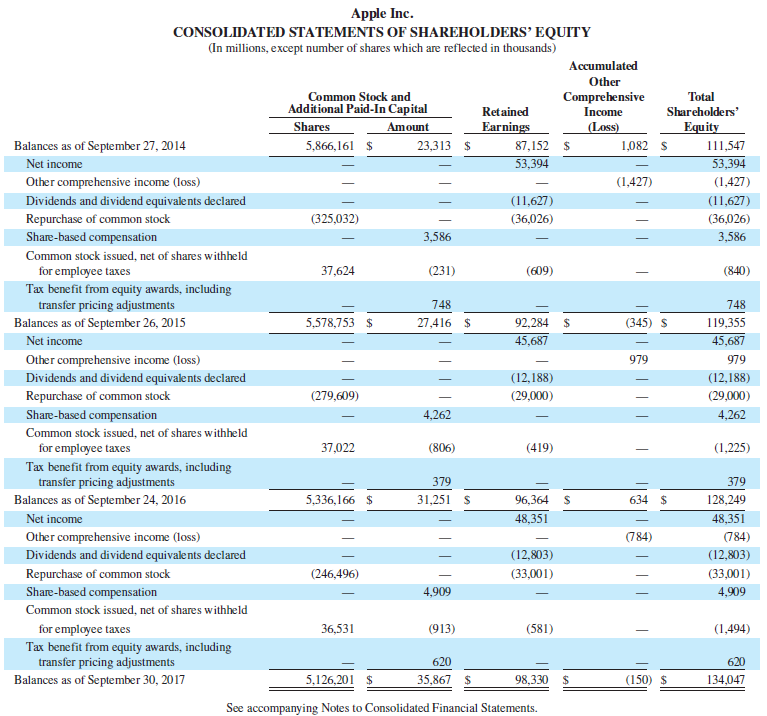

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 24, 2016 September 30, 2017 ASSETS Current assets 24 20,484 Cash and cash equivalents 20,289 53,892 Short-term marketable securities 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 128,645 Total current assets 106,869 170,430 Long-term marketable securities 194,714 Property, plant and equipment, net 33,783 27,010 Goodwill 5,717 5,414 2.298 Acquired intangible assets, net 3,206 Other non-current assets 10,162 8,757 375,319 Total assets 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities 37,294 Accounts payable Accrued ex penses 49,049 25,744 22,027 7,548 De ferred revenue 8,080 Commercial paper 11,977 8,105 Current portion of long-term debt 6,496 3,500 100,814 Total current liabilities 79,006 Deferred revenue, non-current 2,836 2,930 97,207 Long-term debt 75,427 Other non-current liabilities 40,415 36,074 193,437 Total liabilities 241,272 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, S0.00001 par value: 12,600,000 shares authorized; 5,126,201 and 5,336,166 shares issued and outstanding, respectively Retained earnings 35,867 31,251 98,330 96,364 Accumulated other comprehensive income (loss) Total shareholders' equity (150) 634 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 30, 2017 September 24, 2016 September 26, 2015 Net sales 229,234 215,639 24 233,715 Cost of sales 141,048 131,376 84,263 140,089 93,626 Gross margin 88,186 Operating expenses Research and development 11,581 10,045 8,067 Selling, general and administrative Total operating ex penses 15,261 26,842 14,194 24,239 14,329 22.396 Operating income Other income (expense), net 60,024 1,348 71,230 61,344 2,745 1,285 Income before provision for income taxes 64,089 61,372 72,515 Provision for income taxes 15,738 15,685 19,121 Net income 48,351 45,687 53,394 Earnings per share: Basic Diluted %24 9.27 8.35 %24 9.28 9.21 8.31 9.22 Shares used in computing earnings per share: Basic 5,217,242 5,470,820 5,753,421 Diluted 5,251,692 5,500,281 5,793,069 Cash dividends declared per share 2.40 2.18 1.98 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) September 30, 2017 September 24, 2016 September 26, 2015 Years ended Net income 48,351 45,687 S 53,394 Other comprehensive income (loss): Change in foreign currency translation, net of tax effects of S(77), $8 and $201, respectively 224 75 (411) Change in unrealized gains/losses on derivative instruments: Change in fair value of derivatives, net of tax benefit (expense) of S(478), $(7) and $(441), respectively 1,315 2,905 Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $475, $131 and $630, respective ly Total change in unrealized gains/losses on derivative instruments, net of tax (1,477) (741) (3,497) (162) (734) (592) Change in unrealized gains/losses on marketable securities: Change in fair value of marketable securities, net of tax benefit (expense) of $425, $(863) and $264, respectively (782) 1,582 (483) Adjustment for net (gains) losses realized and included in net income, net of tax expense (bene fit) of $35, S(31), and $(32), respectively Total change in unrealized gains/losses on marketable securities, net of tax (64) 56 59 (846) 1,638 (424) Total other comprehensive income (loss) (784) 979 (1,427 Total comprehensive income 47,567 46,666 51,967 See accompanying Notes to Consolidated Financial Statements.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 65% (20 reviews)

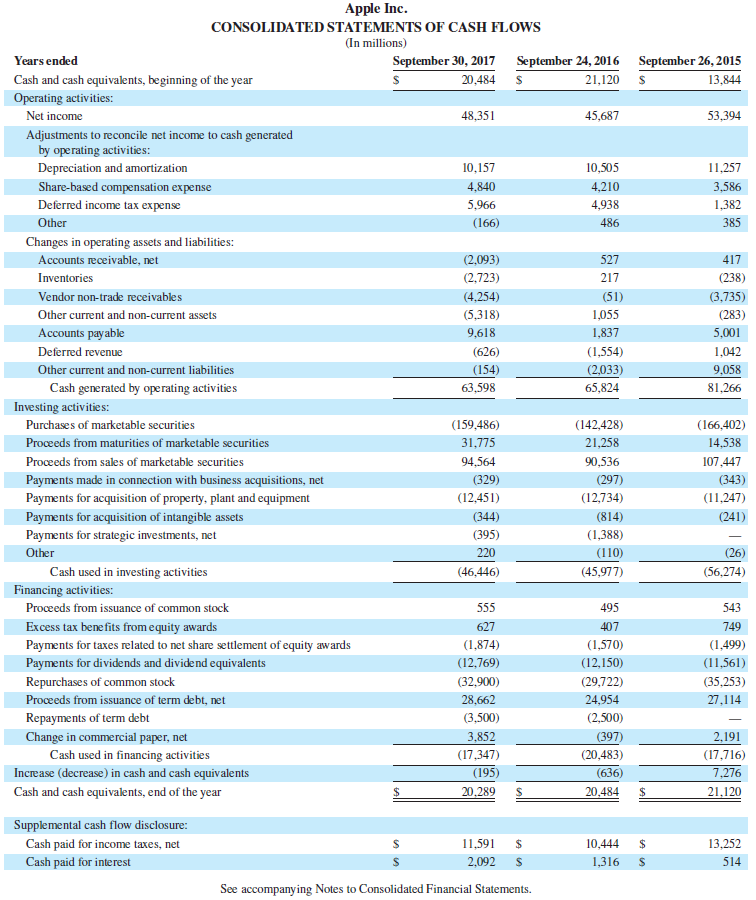

Apple reports accounts payable of 49049 mil...View the full answer

Answered By

AAYAN TRIPATHI

Actually I am not a regular tutor I just do it in my free time.

Since childhood I like to explain things very briefly and deeply and others feel so comfortable when I explain them that encourages me do this more.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Manufacturers such as Research In Motion, Apple, and Palm usually work to maintain a high-quality and low-cost operation. One ratio routinely computed for this assessment is the cost of goods sold...

-

Manufacturers such as Apple and Google usually work to maintain a high-quality and low-cost operation. One ratio routinely computed for this assessment is the cost of goods sold divided by total...

-

Apple and Google work to maintain high-quality and low-cost operations. One ratio routinely computed for this assessment is the cost of goods sold divided by total expenses. A decline in this ratio...

-

Verde Company produces wheels for bicycles. During the year, 657,000 wheels were produced. The actual labor used was 368,000 hours at $9.50 per hour. Verde has the following labor standards: 1)...

-

In the circuit shown, an emf of 150 V is connected across a resistance network. What is the current through R2? Each of the resistors has a value of 10 Ω. R2 R4

-

Consider the following transactions in the shares of Dachshund Airways Ltd: REQUIRED Compute the taxable capital gains, if any, on the 2009 and the 2016 sales. Date April 2004 March 2006 Aug. 2009...

-

Classify the following assets as (1) current assets, (2) plant assets, or (3) intangible assets: (a) land used in operations, (b) office supplies, (c) receivables from customers due in 10 months, id)...

-

Possible causes for price and efficiency variances You are a student preparing for a job interview with a Fortune 109 consumer products manufacturer. You are applying for a job in the Finance...

-

Which of the following best illustrates the concept of sampling risk? Group of answer choices A randomly chosen sample may not be representative of the population as a whole (regarding the...

-

The Tinker Construction Company is ready to begin a project that must be completed in 12 months. This project has four activities (A, B, C, D) with the project network shown next. The project...

-

Locate Googles balance sheet in Appendix A. What is the total of Googles 2017 accounts payable? What is the total of its schedule of accounts payable? Refer to Google Google Inc. (Alphabet Inc.)...

-

Identify each item 1 through 10 with the system component A through E that it is best associated with. A. Source documents B. Input devices C. Information processors D. Information storage E. Output...

-

What aspects contribute to or thwart acceptance of a newcomer into the group?

-

Problem 14-23 (Static) Comprehensive Problem [LO14-1, LO14-2, LO14-3, LO14-5, LO14-6] Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new...

-

The farm business owes income taxes at the end of the year because income taxes are not paid until after the end of the year is true or false

-

So there were some changes in "Kieso intermediate accounting 15th edition"chapter 18 (revenue recognition). Is the test bank the same as before? If not when and what year did the update occur? Please...

-

Explain how competencies are developed through supervised practice. Focus your response on skills application utilizing the psychodynamic or cognitive behavioral approach to supervision. Include...

-

Which statement is correct? Select the best answer. Answer Keypad Keyboard Shortcuts Physical capital deepening has a larger marginal effect in low-income countries than high-income countries. Human...

-

The management of a company finds that 30% of the administrative assistants hired are unsatisfactory. The personnel director is instructed to devise a test that will improve the situation. One...

-

Stephen Schor, an accountant in New York City, advised his client, Andre Romanelli, Inc., to open an account at J. P. Morgan Chase Bank, N.A., to obtain a favorable interest rate on a line of credit....

-

Brussels Enterprises issues bonds at par dated January 1, 2021, that have a $3,400,000 par value, mature in four years, and pay 9% interest semiannually on June 30 and December 31. 1. Record the...

-

Key figures for Apple and Google follow. Required 1. Compute the debt-to-equity ratios for Apple and Google for both the current year and the prior year. 2. Use the ratios from part 1 to determine...

-

Ellis Company issues 6.5%, five-year bonds dated January 1, 2021, with a $250,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $255,333. The annual market...

-

An estimated 84 percent of enterprises now use cloud computing solutions involving multiple clouds, whereas less than 10 percent of large organizations employ just a single public cloud. Group of...

-

XYZ inc. was involved in a tax dispute with the national tax authority. The companys legal counsel estimates that there is a 75% likelihood that the company will lose the dispute and that the amount...

-

3 . Accounting.. How does depreciation impact financial statements, and what are the different methods of depreciation?

Study smarter with the SolutionInn App