Refer to the data in BE6.13 for Smart Information Technology Company. Prior to making the adjustment in

Question:

Refer to the data in BE6.13 for Smart Information Technology Company. Prior to making the adjustment in BE6.13 part (b), cost of goods sold for 2021 was $418,500. What is the correct ending inventory that should be reported on the balance sheet on December 31, 2021? What is the correct cost of goods sold that should be reported on the income statement for the year ended December 31, 2021?

BE6.13

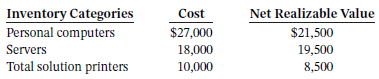

Smart Information Technology Company has the following cost and net realizable value data at December 31, 2021:

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted: