Rent-Center, an equipment rental business, has the following balance sheet on December 31, 2005: Normal annual net

Question:

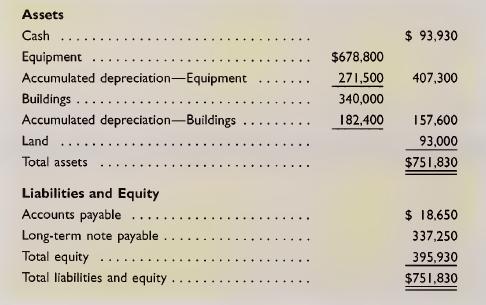

Rent-Center, an equipment rental business, has the following balance sheet on December 31, 2005:

Normal annual net income averages 20% of equity in this industry. Rent-Center regularly expects to earn $100,000 annually. The balance sheet amounts are reasonable estimates of market values for both assets (except goodwill) and liabilities. In negotiations to sell the business, Rent-Center proposes to measure goodwill by capitalizing at a rate of 15% the amount of above-normal net income. The potential buyer thinks that goodwill should be valued at five times the amount of above-normal net income.

Required 1. Compute the amount of goodwill as proposed by Rent-Center.

2. Compute the amount of goodwill as proposed by the potential buyer.

3. The buyer purchases the business for the net asset amount (assets less liabilities) reported on the ecember 31, 2005, balance sheet plus the amount proposed by Rent-Center for goodwill. What is the buyer’s purchase price?

4. If the buyer earns $100,225 ot net income in its first year after acquiring the business under the terms in part 3, what rate of return does the buyer earn on this investment for the first year? Explain how goodwill impacts the buyer’s net income computation.

Step by Step Answer:

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta