Royal Bank of Canada is one of the largest banks in Canada. According to its 2017 annual

Question:

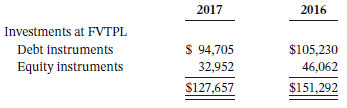

Royal Bank of Canada is one of the largest banks in Canada. According to its 2017 annual report, it had approximately 80,000 employees serving 16 million customers throughout the world. The bank?s business largely involves borrowing money and lending it to others, but at any given time it will have a large amount of money invested in securities when that money is not out on loan. It also acts as an investment dealer, buying investments from one client and selling them to another. The company reported the following information in its 2017 financial statements (in millions of dollars):

Instructions

a. In your opinion, why does the Royal Bank have a higher percentage of its investments held for trading purposes in debt instruments than in equity instruments?

b. How will the debt instruments be valued on the Royal Bank?s balance sheet?

c. The Royal Bank also reported other investments at fair value through other comprehensive income. What are the advantages of reporting gains and losses in other comprehensive income instead of profit? What are the disadvantages?

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak