Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to

Question:

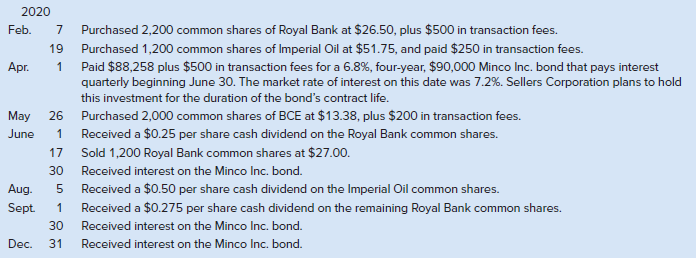

Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to be held as non-strategic investments:

On December 31, 2020, the fair values of the investments held by Safety Development Corporation were: Royal Bank, $27.50; Imperial Oil, $50.13; and BCE, $13.50. Assume the fair value and carrying value of the Minco Inc. bond were equal.

Required

1. Prepare an amortization schedule for the Minco Inc. bond showing only 2020.

2. Prepare journal entries to record the investment activity including the appropriate fair value adjustment on December 31.

3. Show how the investments will be reported on the December 31, 2020, balance sheet.

Analysis Component: If the fair value adjustment is not recorded by Safety Development Corporation, what is the impact on the financial statements?

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann