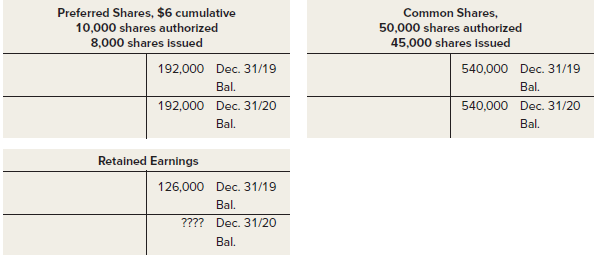

Selected T-accounts for Jade Mineral Corporation at December 31, 2020, are duplicated below. ? Dividends were not

Question:

Selected T-accounts for Jade Mineral Corporation at December 31, 2020, are duplicated below.

? Dividends were not paid during 2018 or 2019. Dividends of $4.80 per common share were declared and paid for the year ended December 31, 2020.

? 2018 was the first year of operations.

? All shares were issued in the first year of operations.

Required

Using the information provided, answer the following questions.

1. What is the total amount of dividends that the preferred shareholders are entitled to receive per year?

2. Are there any dividends in arrears at December 31, 2019? If yes, calculate the dividends in arrears.

3. Calculate total dividends paid during 2020 to the:

a. Preferred shareholders. b. Common shareholders.

4. During 2020, the company earned profit of $408,000. Calculate the balance in the Retained Earnings account at the end of 2020.

5. Calculate Total Contributed Capital at the end of 2020.

6. Calculate Total Equity at December 31, 2020.

7. How many more preferred shares are available for issue at December 31, 2020?

8. What was the average issue price per share of the preferred shares at December 31, 2020?

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann