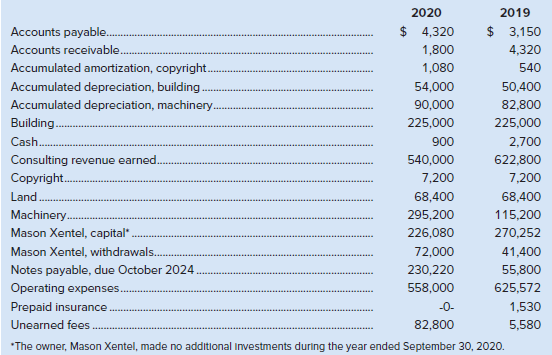

The adjusted balances at September 30, 2020, for Xentel Interactive are shown in alphabetical order below: Required

Question:

The adjusted balances at September 30, 2020, for Xentel Interactive are shown in alphabetical order below:

Required

Prepare a comparative classified balance sheet at September 30, 2020.

Analysis Component: How were Xentel?s assets mainly financed in 2019? in 2020? Has the change in how assets were financed from 2019 to 2020 strengthened the balance sheet? (To strengthen the balance sheet is to decrease the percentage of assets that are financed by debt as opposed to equity.)

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

2020 2019 $ 4,320 $ 3,150 Accounts payable. Accounts receivable.. 1,800 4,320 540 Accumulated amortization, copyright. 1,080 Accumulated depreciation, building Accumulated depreciation, machinery. 54,000 50,400 90,000 82,800 225,000 Building. 225,000 Cash. Consulting revenue earned. 900 2,700 540,000 622,800 7,200 Copyright. 7,200 Land 68,400 68,400 Machinery. Mason Xentel, capital". 295,200 115,200 270,252 226,080 Mason Xentel, withdrawals.. 72,000 41,400 Notes payable, due October 2024 Operating expenses. Prepaid insurance 230,220 55,800 625,572 558,000 -0- 1,530 82,800 Unearned fees 5,580 *The owner, Mason Xentel, made no additional investments during the year ended September 30, 2020.

Step by Step Answer:

Xentel Interactive Balance Sheet September 30 2020 2019 Assets Current assets Cash 900 2700 Accounts ...View the full answer

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Related Video

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a \"prepayment\" for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered. This liability is noted under current liabilities, as it is expected to be settled within a year.

Students also viewed these Business questions

-

The adjusted balances at September 30, 2014, for Xentel Interactive are shown in alphabetical order below: Required Prepare a comparative classified balance sheet at September 30, 2014. Analysis...

-

The adjusted balances at December 31, 2020, for Derlak Enterprises are shown in alphabetical order below: Required Prepare a comparative classified balance sheet at December 31, 2020. Analysis...

-

Todd Motor Company manufactures automobiles. During September 2020, the company purchased 5,000 headlights at a cost of $8 per lights. There was no beginning inventory of lights. Todd withdrew 4,650...

-

How to respond to the following? Cycle stock, pipeline inventory, buffer stock, and in-transit inventory all have associated carrying costs. Interest rates on inventory values, warehousing expenses,...

-

Consider the centralized and the fully distributed approaches to deadlock detection. Compare the two algorithms in terms of message complexity.

-

List the four broad categories used by Foreign Policy magazine to measure the degree of globalization in individual nations.

-

Where did they receive their clinical training (residency, fellowship)?

-

Cardinal Laundromat is trying to enhance the services it provides to customers, mostly college students. It is looking into the purchase of new high-efficiency washing machines that will allow for...

-

The estimated future market values and M&O costs for the following defender and challenger are shown below. We are interested only in what happens over the next three years.If the defender is to be...

-

TeleTech Corporation manufactures two different color printers for the business market. Cost estimates for the two models for the current year are as follows:...

-

After planning to build a new plant, Kallisto Backpack Manufacturing purchased a large lot on which a small building was located. The negotiated purchase price for this real estate was $1,200,000 for...

-

The cost of PPE includes which of the following: a. Its invoice price, less any cash discount for early payment b. Freight, unpacking, and assembling costs c. Non-refundable sales tax (PST) d. All of...

-

Write the molecular equation and the net ionic equation for the reaction of calcium carbonate with nitric acid.

-

In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is...

-

Briefly describe the case you have chosen. Categorize the social worker's experience as vicarious trauma, compassion fatigue, or burnout. Provide justification. Identify the social worker's score on...

-

Given f(x) below, find f'(x). f(x) = = m 5z In (2) et dt

-

Olsen & Alain, CPAs (O&A) performed the audit of Rocky Point Brewery (RPB), a public company in 20X1 and 20X2. In 20X2, O&A also performed tax services for the company. Which statement best describes...

-

Exercise 9-4 (Algo) Prepare a Flexible Budget Performance Report [LO9-4] Vulcan Flyovers offers scenic overflights of Mount Saint Helens, the volcano in Washington State that explosively erupted in...

-

Sincere Stationery Corporation needs to raise $500,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with a 14 percent annual coupon rate and a 10-year maturity....

-

Calculate Total Contribution Margin for the same items. Total Revenue Total Variable Costs Total Contribution Margin $50.00 a. $116.00 $329.70 b. $275.00 $14,796.00 $7,440.00 c. $40,931.25 d....

-

Financial information is presented below for three different companies. InstructionsDetermine the missingamounts. Natural Mattar Allied Cosmetics Grocery Wholesalers Sales $90,000 (e) $144.000 (a)...

-

Financial information is presented below for three different companies. InstructionsDetermine the missingamounts. Natural Mattar Allied Cosmetics Grocery Wholesalers Sales $90,000 (e) $144.000 (a)...

-

There are many situations in business where it is difficult to determine the proper period in which to record revenue. Suppose that after graduation with a degree in finance, you take a job as a...

-

ACCT 401 For each of the following independent situations, indicate the amount the taxpayer must include in gross income: (Leave no answer blank. Enter zero if applicable.) a.Phil won $790 in the...

-

Pompeii, Inc., has sales of $52,000, costs of $23,800, depreciation expense of $2,450, and interest expense of $2,200. If the tax rate is 22 percent, what is the operating cash flow, or OCF? (Do not...

-

Please provide a brief explanation as to whether the following statement is true or false. A foreign exchange trader makes very large losses that are outside the trading limits defined for her desk....

Study smarter with the SolutionInn App