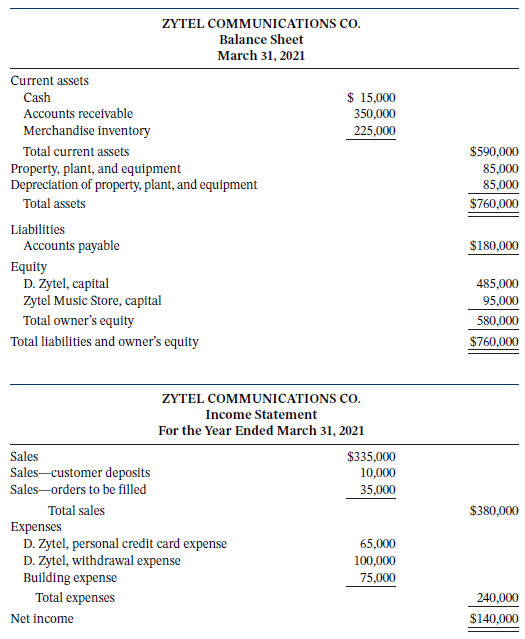

The following financial statements were provided by Zytel Communications Co. The owner, Daniel Zytel, is meeting with

Question:

The following financial statements were provided by Zytel Communications Co. The owner, Daniel Zytel, is meeting with an investor who is interested in investing in the company. The investor has requested these financial statements before considering the investment. Daniel has asked you to look at the statements and provide feedback. Zytel uses the earnings approach for revenue recognition. All sales are made with terms of n/30.

Additional information provided:

1. The Accounts Receivable balance includes amounts owing from customers of $35,000 and the remaining amount represents an investment in the common shares of a speculative mining company. Daniel believes that he will collect about 95% of the receivables but will wait and see what happens.

2. Property, plant, and equipment assets are being depreciated over two years even though they are expected to have a useful life of five years. Daniel considers depreciation a fund to purchase additional assets in the future and has the bookkeeper record it as an asset.

3. Merchandise inventory on hand has a realizable value of $20,000 and a cost of $18,000. Zytel does not adjust merchandise inventory on the balance sheet for any amounts that are sold.

4. Accounts payable includes a bank loan from the Bank of Quebec. The term of the bank loan is 10 years and payments of principal and interest are made monthly.

5. Daniel owns a music store in addition to the communications business. The bookkeeper records some of the music store?s transactions in the communications business and credits the equity account Zytel Music Store?Capital.

6. All the company?s operating costs are paid by Daniel using his personal credit card so that he can accumulate travel points. The bookkeeper records all payments on the card as an expense to the company.

7. The building expense refl ects the cost of an addition built for inventory storage.

Instructions

Using the concepts in the conceptual framework covered in this chapter, answer the following questions:

a. Are these statements useful to the investor? What information will the investor be looking for when considering the investment?

b. Determine if the assets, liabilities, revenues, and expenses recognized in the financial statements are appropriate. If an element is incorrectly recognized, explain why.

c. Has Zytel followed the guidance for relevance and faithful representation? If not, what are the violations?

d. Are there any revenue recognition problems that you can see? Are there any measurement problems? If so, how would these problems be corrected?

e. Have the reporting entity and full disclosure concepts been followed? Explain.

Taking It Further

Daniel has heard that property, plant, and equipment assets can be recorded at fair value instead of historical cost. Explain to Daniel how this might be advantageous to current and potential investors.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak