The following information (dollars in millions) is for Canadian Tire Corporation, Limited. Instructions a. Calculate the gross

Question:

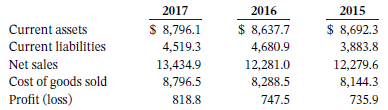

The following information (dollars in millions) is for Canadian Tire Corporation, Limited.

Instructions

a. Calculate the gross profit margin, profit margin, and current ratio for Canadian Tire for 2017, 2016, and 2015.

b. Comment on whether the ratios have improved or deteriorated over the three years.

What other information would be useful when evaluating these ratios over the threeyear period?

2016 Current assets Current liabilities Net sales Cost of goods sold Profit (loss) 2017 $8,796.1 4,519.3 13,434.9 8,796.5 818.8 $ 8,637.7 4,680.9 12,281.0 8,288.5 747.5 2015 $ 8,692.3 3,883.8 12,279.6 8,144.3 735.9

Step by Step Answer:

a amounts in millions 2017 2016 2015 Gross profit margin 3453 134349 87965 134349 3251 122810 82885 ...View the full answer

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

The current ratio is a financial ratio that measures a company\'s ability to pay its short-term obligations with its short-term assets. It is calculated by dividing a company\'s current assets by its current liabilities. The formula for calculating the current ratio is: Current Ratio = Current Assets / Current Liabilities Current assets are assets that can be converted to cash within one year, while current liabilities are debts that are due within one year. A current ratio of 1:1 or greater is generally considered good, as it indicates that a company has enough current assets to cover its current liabilities. A current ratio of less than 1:1 may suggest that a company may have difficulty meeting its short-term obligations. It\'s important to note that the current ratio is just one of many financial ratios that can be used to assess a company\'s financial health. It should be used in conjunction with other financial ratios and qualitative factors to make informed decisions about investing or lending to a company.

Students also viewed these Business questions

-

The following information (in thousands) is for Danier Leather Inc.: ___________________2011 2010 2009 Current assets..........$ 59,370......$ 55,241........$ 48,056 Current...

-

The following selected information is available for Canfor Corporation, a British Columbia-based forest products company, for three fiscal years (in $ millions): Instructions (a) Calculate the...

-

The following selected information is available for Volvo Group, headquartered in Sweden, for three fiscal years (in SEK [Swedish krona] millions): Instructions (a) Calculate the current ratio, gross...

-

Marc & Kent operate a vineyard as partners. The partnership trades under the business name Victor Estate. Victor Estate has prepared a general ledger for the 2023 income year showing the following...

-

A series RLC circuit has R = 80 , L = 240 mH, and C = 5 mF. If the input voltage is v(t) = 10 cos 2t find the currrent flowing through the circuit.

-

If a 33 percent food cost is required and a menu item sells for $16.95, what is its cost supposed to be? LO.1

-

What is the ACT-R model?

-

Doris subscribed for two hundred shares of 12 percent cumulative, participating, redeemable, convertible, preferred shares of the Ritz Hotel Company with a par value of $100 per share. The...

-

On December 1, Year 1, John and Patty Driver formed a corporation called Susquehanna Equipment Rentals. The new corporation was able to begin operations immediately by purchasing the assets and...

-

An end loader for a small garden tractor is shown. All connections are pinned. The only significant weight is W . (a) Draw six FBDs, one each for members BC, DG, and AEF , plate CDE, hydraulic...

-

Magna International Inc. is a leading global supplier of technologically advanced automotive components, systems, and modules. Selected financial information (in US$ millions) follows: Instructions...

-

At year end, the perpetual inventory records of Guiterrez Company showed merchandise inventory of $98,000. The company determined, however, that its actual inventory on hand was $96,100. Record the...

-

Before writing: LO1 a What action do you expect from this report? b Who will read it? c How short can it be?

-

What questions would you like to ask of Cassie to better understand any factors that may be affecting Sasha at this time? Growing sunflowers It's now week 6 into the growing sunflowers project. Your...

-

n rope is fixed to a wall and attached to the block such that the rope is parallel to the surface of the wedge. The 12 points) Consider the situation in the figure where a square block (mi) sits...

-

The requirement for extended disclosures for oil and gas reserves described in Chapter 2 followed a Congressional hearing on the poor disclosures that Shell Oil had for its reserves. A.Explain three...

-

Question 9 Big Data techniques implemented in the financial sector include: fraud detection O marketing email campaign O customer relationship management techniques O inventory analysis

-

Problem 8-19A Attaining notfonpmt entity variances The Redmond Management Association held its annual public relations luncheon in April Year 2. Based on the previous year's results, the organization...

-

Tobias is a 50% member in Solomon LLC, which does not invest in real estate. On January 1, Tobiass adjusted basis for his LLC interest is $130,000, and his at-risk amount is $105,000. His share of...

-

The tractor is used to lift the 150-kg load B with the 24-mlong rope, boom, and pulley system. If the tractor travels to the right at a constant speed of 4 m/s, determine the tension in the rope when...

-

Precision Inc. issued $900,000 of 10-year, 5% bonds on January 1, 2021. Interest is to be paid semi-annually. The market interest rate was 6%. a. What is the face value of the bond? When will this be...

-

Whittemore Corp. issued $500,000 of 3-year, 4% bonds on May 1, 2021. The market interest rate when the bonds were issued was 8%. Interest is payable quarterly. Instructions a. What is the number of...

-

On January 1, 2021, Global Satellites issued $1.4-million, 10-year bonds. The bonds pay semi-annual interest on July 1 and January 1, and Global has a December 31 year end. A partial bond...

-

This is the solved part A. Just need help in solving the next questions from 1-6. These four pages are interconnected one by one as i posted. First part was solved as I uploaded the picture...

-

WHEN INVESTORS PREFER SHORT TERM INVESTMENTS THIS IS CALLED

-

You have been advised that the cost of ordinary equity is 8%, preference shares are 10% and pre-tax cost of debt is 7%. The weights of preference shares is 25% and ordinary shares are 45%. The tax...

Study smarter with the SolutionInn App