The following is information from Crystal Company?s adjusted trial balance at December 31, 2021: Instructions a. Prepare

Question:

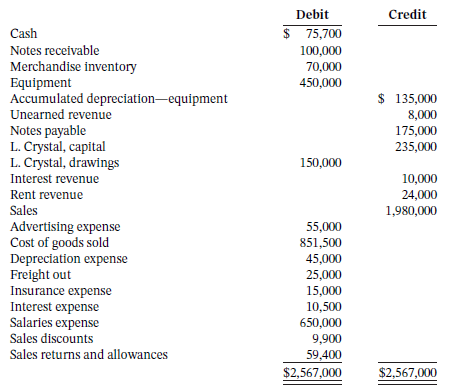

The following is information from Crystal Company?s adjusted trial balance at December 31, 2021:

Instructions

a. Prepare a single-step income statement for the year ended December 31, 2021.

b. Prepare closing entries and a post-closing trial balance.

Debit Credit $ 75,700 Cash Notes receivable 100,000 70,000 450,000 Merchandise inventory Equipment Accumulated depreciation-equipment Unearned revenue $ 135,000 8,000 175,000 235,000 Notes payable L. Crystal, capital L. Crystal, drawings 150,000 10,000 24,000 1,980,000 Interest revenue Rent revenue Sales Advertising expense Cost of goods sold Depreciation expense Freight out Insurance expense 55,000 851,500 45,000 25,000 15,000 10,500 650,000 Interest expense Salaries expense Sales discounts 9,900 59,400 Sales returns and allowances $2,567,000 $2,567,000

Step by Step Answer:

a b Dec 31 Sales 1980000 Interest Revenue 10000 Rent Revenue 24000 Income Summary 2014000 To close i...View the full answer

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Prepare Carissa Communications multi-step income statement for the year ended July 31, 2016. Carissa Communications reported the following figures from its adjusted trial balance for its first year...

-

Prepare Budget's single-step income statement for the year ended March 31, 2015. The adjusted trial balance of Budget Business Systems at March 31, 2015, follows: BUDGET BUSINESS SYSTEMS Adjusted...

-

Prepare Budget's multi-step income statement for the year ended March 31, 2015. The adjusted trial balance of Budget Business Systems at March 31, 2015, follows: BUDGET BUSINESS SYSTEMs Adjusted...

-

Tin - Can, Inc. Aircraft ( TCAI ) R&D Project Management Problem Your group is hired to help TCAI Project Manager to solve the following problem. Using the activity time estimates and activity...

-

Express the following functions in cosine form: (a) 4 sin ( t - 30o) (b) -2 sin 6t (c) -10sin( t + 20o)

-

Organization: Chilis Grill and Bar Summary: Chilis is a fun and exciting place to have burgers, fajitas, margaritas, and chili. Established in 1975 in Dallas, the chain now has more than 637...

-

What are the different kinds of nondeclarative knowledge?

-

In divisional income statements prepared for Wilborne Construction Company, the Pay-roll Department costs are charged back to user divisions on the basis of the number of payroll checks, and the...

-

Entry for Factory Labor Costs A summary of the time tickets is as follows: Job No. Amount 55 $3,800 57 3,150 58 5,780 60 6,570 Indirect 20,250 66 4,010 67 2,630 70 17,800 Journalize the entry to...

-

Tonys Precision Computer Centre is picking up in business, so he has decided to expand his bookkeeping system to a general journal/ledger system. The balances from June have been forwarded to the...

-

At year end, the perpetual inventory records of Guiterrez Company showed merchandise inventory of $98,000. The company determined, however, that its actual inventory on hand was $96,100. Record the...

-

Nelson Company provides the following information for the month ended October 31, 2021: sales on credit $280,000, cash sales $95,000, sales discounts $5,000, and sales returns and allowances $11,000....

-

What is Pr (X = n) for a geometric random variable with parameter p (the probability of success)? What is E(X ) in this case?

-

Totally Chemical is considering an investment decision project in which the organization expands into the trucking business. Totally Chemical wants to begin this investment decision project by buying...

-

Presented below is the balance sheet of Sandhill Corporation as of December 31, 2017. SANDHILL CORPORATION BALANCE SHEET DECEMBER 31, 2017 Goodwill (Note 2) Buildings (Note 1) Inventory Land Accounts...

-

Find the best predicted tip for a ride that is 3.10 miles. How does the result compare to the actual tip of $4.55? Find the best predicted fare amount for a distance of 3.10 miles. How does the...

-

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate...

-

I have asked three questions with my textbook chapter in which they come from. it would be greatly appreciated if you could help me answer these three questions. Thanks so much. :) 1. What is the...

-

The present value of $3,000 at the end of seven years at 8% interest is a. $2,228. b. $1,749. c. $3,000. d. $15,618. Select the best choice from among the possible answers given.

-

In Exercises delete part of the domain so that the function that remains is one-to-one. Find the inverse function of the remaining function and give the domain of the inverse function. f(x) = 16x4 -3...

-

Colton Cars Co. issued $1.8 million of 5%, 5-year bonds on January 1, 2021. The bonds were dated January 1 and pay interest annually. The bonds are secured with real estate holdings. The market...

-

Glover Corporation issued $3.5 million of 6%, 5-year bonds on January 1, 2021. The bonds were dated January 1 and pay interest annually. Glover has a December 31 year end. The bonds are secured with...

-

On October 1, 2021, PFQ Corp. issued $800,000 of 10-year, 5% bonds at 98. The bonds pay interest annually on October 1. PFQs year end is September 30. Instructions a. Record the issue of the bonds on...

-

If the risk-free rate is 1.0% and the expected market return is 6.6%, what is the WACC of the company with the following characteristics? Answer in percent, rounded to two decimal places. Market...

-

List and describe some of socioeconomic items in a government retirement pension plan. (actuarial report

-

Explain the difference between necessary and optional expenses.

Study smarter with the SolutionInn App