Using the data in situation a of Exercise 11-6, prepare the employers September 30 journal entries to

Question:

Using the data in situation a of Exercise 11-6, prepare the employer’s September 30 journal entries to record (1) salary expense and its related payroll liabilities for this employee and (2) the employer’s payroll taxes expense and its related liabilities. The employee’s federal income taxes withheld by the employer are $135 for this pay period.

Exercise 11-6

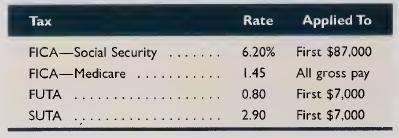

MRI Co. has one employee, and the company is subject to the following taxes:

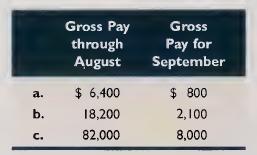

Compute MRI’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), {b), and (c):

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles

ISBN: 9780072946604

17th Edition

Authors: Kermit D. Larson, John J Wild, Barbara Chiappetta

Question Posted: