Using the information and analysis prepared in QS 2-6, prepare the journal entries for the month of

Question:

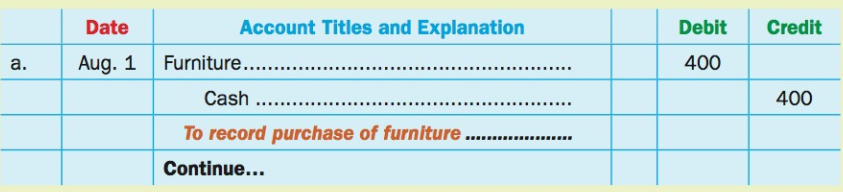

Transcribed Image Text:

Account Titles and Explanation Debit Date Credit Aug. 1 a. Furniture.... 400 Cash 400 To record purchase of furniture . Continue...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

Date Account Titles and Explanation Debit Credit a Aug 1 Furniture 400 Cash ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 1

ISBN: 9781259259807

15th Canadian Edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Using the information in QS 8 through QS 10, prepare journal entries to record each of the transactions of the merchandising companies assuming a periodic inventory system. In QS 8 Sept. 1 Sold...

-

Using the information in QS 18, prepare the closing entries. In QS 18 Merchandise inventory (January 1, 2014)........................................................... $ 40,000 Kay Bondar,...

-

Using the information in QS 4-14, calculate Tucker Companys quick ratio (round to two decimal places). Information 4-14 Calculate Tucker Companys current ratio, given the following information about...

-

Advertising plays a major role in the ______________ stage of the product life cycle, and_______________ plays a major role in the maturity stage.

-

The Abrams Corporation incurred the following quality costs for the year ending December 31, 2012: (a.) What are the total prevention costs for the Abrams Corporation? (b.) What are the total...

-

Level 85% In Exercises 2528, find the critical value z2 needed to construct a confidence interval with the given level.

-

155.9 Source: United States Social Security Administration. a. Compute a simple composite index for the number of workers in the three insured categories using 2000 as the base period. b. Is the...

-

During the year, the following sales transactions occur. There is a charge of 3% on all credit card transactions and a 1% charge on all debit card transactions. Calculate the amount recorded as cash...

-

Transactions related to revenue and cash receipts completed by Augusta Inc. during the month of March 20Y8 are as follows: Mar. 2. Issued Invoice No. 512 to Santorini Co., $925. 4. Received cash from...

-

There is considerable strain in forming a flat ring so it is only adopted when there is some sort of stabilization that outweighs this. This extra stability is aromaticity. From your research on the...

-

Douglas Malone started CityBnB, which is a bed and breakfast in Vancouver. City BnB offers accommodations and breakfast to travelers exploring the city. The following are the transactions for the...

-

CityBnBs records showed the following beginning balances on July 31, 2017. Using the information provided and the analysis completed in QS 2-6 and QS 2-7, complete the following: 1. Post the journal...

-

What is meant by the foreign currency being at covered interest arbitrage parity (CIAP)? What are some of the forces that can prevent the achievement of CIAP?

-

460 V rms 3 phase full wave controlled rectifier feeds an inductive load. The supply voltage has a frequency of 50 Hz. If thyristors are considered ideal; a) Draw the voltage on the load when a = 25....

-

The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company Pepper Company Finished goods inventory, beginning $14,000 $17,950 Work in process...

-

On September 22, 2024, a flood destroyed the entire merchandise inventory on hand in a warehouse owned by the Rocklin Sporting Goods Company. The following information is available from the records...

-

A wound DC motor is connected in both a shunt and a series configuration. Assume generic resistance and inductance parameters Ra, Rf, La, Lf, let the field magnetization constant be kf and the...

-

Supermart Food Stores (SFS) has experienced net operating losses in its frozen food products line in the last few periods. Management believes that the store can improve its profitability if SFS...

-

Sketch the coordinate axes and then include the vectors u, v, and u * v as vectors starting at the origin. u = i + j, v = i - j

-

QUESTION 9 HC-O-C-R R-C-O-CH HC-O-P-O-CH-CH-NH3* O || O a. Phosphatidic acid, Serine O b. Lysophosphatidic acid, Serine, Free FA O c. Lysophosphatidylserine, Free FA O d. 2 Free FAs, Serine, Glycerol...

-

On December 31, 2020, Toro Company?s Allowance for Doubtful Accounts had an unadjusted credit balance of $31,000. The accountant for Toro has prepared a schedule of the December 31, 2020, accounts...

-

The estimated bad debt expense is recorded with the following adjusting entry at the end of the accounting period: a. Dr. Bad Debt Expense , Cr. Allowance for Doubtful Accounts b. Dr. Allowance for...

-

On December 31, 2020, Stilton Service Company?s year-end, the unadjusted trial balance included the following items: Required 1. Prepare the adjusting entry on the books of Stilton Service Company to...

-

Saly paid $52,000 a year paid on a weekly basis. last pay she had $250 withheld in Income Tax, $48.97 for CPP and $15.80 for EI. an additional $and 25.00 in tax are deducted each pay. She allowed to...

-

Required information [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Asset Drill bits (5-year) Drill bits...

-

Which of the following partnership items are not included in the self-employment income calculation? Ordinary income. Section 179 expense. Guaranteed payments. Gain on the sale of partnership...

Study smarter with the SolutionInn App