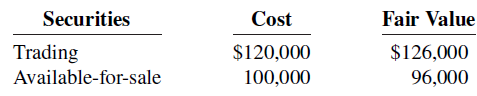

Uttinger Company has the following data at December 31, 2020. The available-for-sale securities are held as a

Question:

The available-for-sale securities are held as a long-term investment.

Instructions

a. Prepare the adjusting entries to report each class of securities at fair value.

b. Indicate the statement presentation of each class of securities and the related unrealized gain (loss) accounts.

Transcribed Image Text:

Fair Value Securities Cost Trading $120,000 100,000 $126,000 96,000 Available-for-sale

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

a Fair Value Adjustment x Trading 126000 120000 6000 Unrealized Gain x In...View the full answer

Answered By

Amar Kumar Behera

I am an expert in science and technology. I provide dedicated guidance and help in understanding key concepts in various fields such as mechanical engineering, industrial engineering, electronics, computer science, physics and maths. I will help you clarify your doubts and explain ideas and concepts that are otherwise difficult to follow. I also provide proof reading services. I hold a number of degrees in engineering from top 10 universities of the US and Europe.

My experience spans 20 years in academia and industry. I have worked for top blue chip companies.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Business questions

-

Uttinger Company has the following data at December 31, 2014. The available-for-sale securities are held as a long-term investment. Instructions (a) Prepare the adjusting entries to report each class...

-

Uttinger Company has the following data at December 31, 2015. The available-for-sale securities are held as a long-term investment. Instructions (a) Prepare the adjusting entries to report each class...

-

Uttinger Company has the following data at December 31, 2017. The available-for-sale securities are held as a long-term investment. Instructions (a) Prepare the adjusting entries to report each class...

-

Parent Ltd owns 80% of Subsidiary Ltd. In the financial year ended 30 June 20X2, Subsidiary Ltd sold inventory to Parent Ltd. Details regarding the transaction are as follows: Cost to Subsidiary to...

-

Given the following information for Janicek Power Co., find the WACC. Assume the company's tax rate is 35 percent. Debt: 8,500 7.2 percent coupon bonds outstanding, $1,000 par value, 25 years to...

-

In order to determine the effects of collegiate athletic performance on applicants, you collect data on applications for a sample of Division I colleges for 1985, 1990, and 1995. (i) What measures of...

-

Find out the Material variances: Materials Std. Qty. Std. Price Actual Qty. Actual Price (Kg) (Rs.) (Kg.) (Rs.) A 50 2 60 3 B 25 5 30 4 75 90 [Ans.: (i) MVC : A = Rs. 80 (Adv.), B = Rs. 5 (Fav.);...

-

Vandenberg, Inc., produces and sells two products: a ceiling fan and a table fan. Vandenberg plans to sell 30,000 ceiling fans and 70,000 table fans in the coming year. Product price and cost...

-

What is the nonseparately stated income amount of an accrual-basis, calendar-year S corporation with the following items? Gross receipts Interest income Rental income Cost of goods sold and...

-

Since opening day, Arnold Palmer Hospital has experienced an explosive growth in demand for its services. One of only six hospitals in the U.S. to specialize in health care for women and children....

-

Data for debt investments classified as trading securities are presented in E16.10. Assume instead that the investments are classified as available-for-sale debt securities. They have the same cost...

-

Jill Ernst is the controller of J-Products, Inc. At December 31, the end of its first year of operations, the companys investments in trading debt securities cost $74,000 and have a fair value of...

-

Product mix and special order decisions Orion Outdoors Company produces a standard model and a high-quality deluxe model of lightweight tents. Orion's workforce is organized into production teams...

-

Why is it critical to immediately contact your Engagement Partner when you suspect or identify non-compliance? He or she will ensure that the non-compliance doesn't affect the Client's reputation He...

-

Question 9: Determine the current and its direction, in each resistor, for the circuit shown below. Show your calculations. R=152 9.0 V + 12V ww R=75 2 R3= 50

-

how can The High - Tech Way To Recycle Clothes sustainable. and what they offer and what are their ecofriendly

-

James Bondbuyer purchases a Treasury bond on Monday, May 2, regular way settlement. The bond pays interest on January 15 and July 15. How many days of accrued interest will be owed to the seller? A...

-

Aviation and air traffic control have come a long way in the last 100-years. Some believethat we have reached a plateau and that growth in aviation will stop. Aviation may go the way of the railroads...

-

Suncor is planning to issue debt that will mature in the year 2037. In many respects the issue is similar to currently outstanding debt of the corporation. Using Table 11- 2 in the chapter, identify...

-

In Problems, solve each system of equations. x + 2y + 3z = 5 y + 11z = 21 5y + 9z = 13

-

Suzaki Manufacturing Company is considering three new projects, each requiring an equipment investment of $22,000. Each project will last for 3 years and produce the following cash inflows. The...

-

Rondello Company is considering a capital investment of $150,000 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value ....

-

Omega Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Annual income is constant over the life of the project. Each project is expected to...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App