A company reports the following for the past year. The companys CFO believes that income for next

Question:

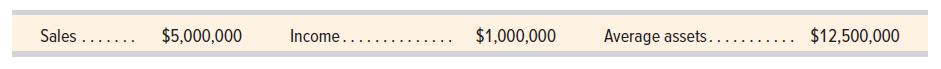

A company reports the following for the past year.

The company’s CFO believes that income for next year will be $1,200,000. Average assets will be the same as the past year.

1. Compute return on investment for the past year.

2. If the CFO’s forecast is correct, what will return on investment be for next year?

Transcribed Image Text:

Sales ....... $5,000,000 Income... $1,000,000 Average assets... $12,500,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

Return on Investment Net Income ...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

A company reports the following income statement and balance sheet information for the current year: Net income $ 400,000 Interest expense 20,000 Average total assets 3,500,000 Determine the rate...

-

A company reports the following income statement and balance sheet information for the current year: Net income $ 600,000 Interest expense 75,000 Average total assets 4,500,000 Determine the rate...

-

A company reports the following income statement and balance sheet information for the current year: Net income .......$ 820,000 Interest expense ..... 80,000 Average total assets .....5,000,000...

-

IKEA was founded in 1943 by a 17-year-old Swede named Ingvar Kamprad. The company, which initially sold pens, Christmas cards, and seeds from a shed on Kamprad?s family farm, eventually grew into a...

-

An ordinary portable fan blows 0.2 kg/s room air with a velocity of 18 m/s. What is the minimum power electric motor that can drive it? Are there any changes in P or T?

-

Discuss methods of performance evaluations.

-

From the following information, calculate the different labour variances: Standard Workers No. of Rate per Hrs. Amount Rs. Workers Workers Worker 100 3 100 30,000 Women 50 5 100 25,000 Boys 40 10 100...

-

June production generated the following activity in Car Chassis Companys Work-in-Process Inventory account: June 1 balance................$ 38,000 Direct materials used............. 43,000 Direct...

-

Ruestion 5 17 points) Easton Company prepares annual adjusting entries only. During the third quarter of Fiscal Year 2018, Easton Company acquired the following trading securities: Date Company # of...

-

Company X-Co has a $10,000,000 gain from exercising stock options. What topic and subtopics would the researcher highlight in the left navigation panel to discover the relevant authority to resolve...

-

A companys division has sales of $2,000,000, income of $80,000, and average assets of $1,600,000. Compute the divisions profit margin, return on investment, and investment turnover.

-

Fill in the blanks in the schedule below for two separate investment centers A and B. Investment Center Sales .. $. $10,400,000 Income.... $ 240,000 $ Average assets.. $1,200,000 $ Profit margin.....

-

Consider the following functions Y i (s) = L[y i (t)], i = 1, 2 and 3, where {y i (t), i = 1, 2, 3} are the complete responses of differential equations with zero initial conditions. (a) For each of...

-

From your reading this unit on motivation and change from the TIP series, what is the connection and interplay between these concepts/statements below in your opinion in working with clients facing...

-

Please help with the following The partnership of Bauer, Ohtani, and Souza has elected to cease all operations and liquidate its business property. A balance sheet drawn up at this time shows the...

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,200 cases of Oktoberfest-style beer from a German supplier for 276,000 euros. Relevant U.S. dollar exchange rates for the euro...

-

Define meaning of partnership deed.

-

List down the information contains in the partnership deed.

-

The accountant for Evas Laundry prepared the following unadjusted and adjusted trial balances. Assume that all balances in the unadjusted trial balance and the amounts of the adjustments are correct....

-

Use a calculator to evaluate the expression. Round your result to the nearest thousandth. V (32 + #)

-

Tailspin Trading Co. has the following products in its ending inventory . Compute lower of cost or market for inventory applied separately to eachproduct. Product Quantity Mountain bikes. Skateboards...

-

In taking a physical inventory at the end of year 2011, Nadir Company forgot to count certain units. Explain how this error affects the following: (a) 2011 cost of goods sold, (b) 2011 gross profit,...

-

Market Company begins the year with $200,000 of goods in inventory. At year-end, the amount in inventory has increased to $230,000. Cost of goods sold for the year is $1,600,000. Compute Markets...

-

Deacon Company is a merchandising company that is preparing a budget for the three - month period ended June 3 0 th . The following information is available Deacon Company Balance Sheet March 3 1...

-

Mango Company applies overhead based on direct labor costs. For the current year, Mango Company estimated total overhead costs to be $460,000, and direct labor costs to be $230,000. Actual overhead...

-

Which of the following do we expect to be the horizon growth rate for a company (long term growth rate- say 30-50 years)? A) Inflation B) Industry Average C) Zero D) Market Beta

Study smarter with the SolutionInn App