In 2017, DelCano Properties paid $540,000 for a tract of land on which two buildings were located.

Question:

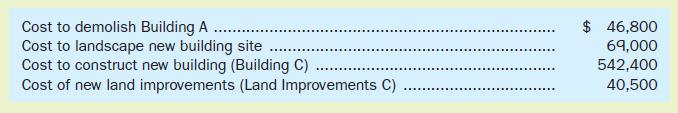

In 2017, DelCano Properties paid $540,000 for a tract of land on which two buildings were located. The plan was to demolish Building A and build a new factory (Building C) in its place. Building B was to be used as a company office and was appraised at a value of $189,108. A lighted parking lot near Building B had improvements valued at $50,058. Without considering the buildings or improvements, the tract of land was estimated to have a value of $317,034.The company incurred the following additional costs:

Required1. Prepare a schedule having the following column headings: Land, Building B, Building C, Land Improvements B, and Land Improvements C. Allocate the costs incurred by the company to the appropriate columns and total each column.

2. Prepare a single journal entry dated June 1 to record all the incurred costs, assuming they were paid in cash on that date.

Step by Step Answer:

Fundamental Accounting Principles Volume 2

ISBN: 9781259087363

15th Canadian Edition

Authors: Kermit Larson, Heidi Dieckmann