Internal rates of return for three alternative investment projects follow. Each project has a five-year life. The

Question:

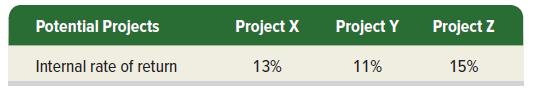

Internal rates of return for three alternative investment projects follow. Each project has a five-year life. The company requires a 12% rate of return on its investments.

(a) Which project(s) will the company accept on the basis of internal rate of return?

(b) If the company can choose only one project, which will it choose?

Transcribed Image Text:

Potential Projects Project X Project Y Project Z Internal rate of return 13% 11% 15%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

a The company will accept projects X and Z as they have an i...View the full answer

Answered By

Dennis Nyangau

I have been tutoring for several years now, and I absolutely love it! I love being able to help students one-on-one and see them succeed. It is so gratifying to see a student understand a concept that they were struggling with before. I also enjoy getting to know my students and helping them to reach their full potential.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Related Video

Internal rate of return is a method of calculating an investment’s rate of return. The term internal refers to the fact that the calculation excludes external factors, such as the risk-free rate, inflation, the cost of capital, or financial risk.

Students also viewed these Business questions

-

The profitability indexes for three alternative investment projects follow. Each project has a five-year life. (a) Which project(s) will the company accept on the basis of profitability index? (b) If...

-

A company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. a. Compute the net...

-

Calculate Mean and Mode of the following. 0-5 5-10 4 Class Frequency 10-15 6 15-20 4 20-25 25-30 5 30-35 6

-

Arginine, the most basic of the 20 common amino acids, contains a guanidino functional group in its side chain. Explain, using resonance structures to show how the protonated guanidino group...

-

A house is heated by a heat pump driven by an electric motor using the outside as the low-temperature reservoir. The house loses energy directly proportional to the temperature difference as Q loss =...

-

Describe the difference between fixed-quantity (Q) and a fixed-period (P) inventory system.

-

Suppose you have developed a regression model to explain the relationship between y and x1, x2, and x3. The ranges of the variables you observed were as follows: 10 y 100, 5 x1 55, .5 x2 1, and...

-

Neville Companys standard materials cost per unit of output is $10 (2 pounds _ $5). During July, the company purchases and uses 3,200 pounds of materials costing $16,160 in making 1,500 units of...

-

Your company wants to issue new 25-year bonds for some much needed expansion projects. You currently have 7.80% coupon bonds on the market that sells for $1,125, make semiannual payments, and mature...

-

MNLogs harvested logs (with no inputs from other companies) from its prop¬erty in northern Minnesota. It sold these logs to MNLumber for $1,500 and MNLumber cut and planed the logs into lumber....

-

Refer to the information in Exercise 26-10. (a) Create an Excel spreadsheet to compute the internal rate of return for each of the projects. (b) Based on internal rate of return, determine whether...

-

Refer to the information in Exercise 26-17. Create an Excel spreadsheet to compute the internal rate of return for the proposed investment. Data From Exercise 26-17 OptiLux is considering investing...

-

The bond price curve is said to have a convex shape. What does this mean in terms of increases and decreases in interest rates relative to changes in bond prices?

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,500 cases of Oktoberfest-style beer from a German supplier for 390,000 euros. Relevant U.S. dollar exchange rates for the euro...

-

Palmerstown Company established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $1.00/pound. Palmerstown negotiated a bank loan of...

-

Required information [The following information applies to the questions displayed below.] The following is financial information describing the six operating segments that make up Chucktown Sauce...

-

Question 1 (50 marks) Costa Ltd is a company with a 30 June year end. The following information relates to Costa Ltd and its subsidiary Jumbo for the year ended 30 June 20.22. Costa Ltd Jumbo Ltd Dr...

-

The following salaried employees of Mountain Stone Brewery in Fort Collins, Colorado, are paid semimonthly. Some employees have union dues or garnishments deducted from their pay. You do not need to...

-

Financial information related to Organic Products Company for the month ended June 30, 20Y9, is as follows: Net income for June..............................................$115,000 Dividends paid in...

-

Create an appropriate display of the navel data collected in Exercise 25 of Section 3.1. Discuss any special properties of this distribution. Exercise 25 The navel ratio is defined to be a persons...

-

Ogden Co. manufactures a single product in one department. All direct materials are added at the beginning of the manufacturing process. Direct labor and overhead are added evenly throughout the...

-

Refer to the data in Problem 20-5A. Assume that Ogden uses the FIFO method to account for its process costing system. The following additional information is available: Beginning goods in process...

-

Tarick Toys Company manufactures video game consoles and accounts for product costs using process costing. The following information is available regarding its June inventories. The following...

-

What is Apple Companys strategy for success in the marketplace? Does the company rely primarily on customer intimacy, operational excellence, or product leadership? What evidence supports your...

-

Exercise 1 1 - 7 ( Algo ) Net present value and unequal cash flows LO P 3 Gomez is considering a $ 2 1 0 , 0 0 0 investment with the following net cash flows. Gomez requires a 1 2 % return on its...

-

a Campbell Inc. produces and sells outdoor equipment. On July 1, 2011. Campbell issued $40,000,000 a 10-year, 10% bonds at a market (effective) interest rate of 9%, receiving Cash of 548,601,480....

Study smarter with the SolutionInn App