Lopez Co. is considering three alternative investment projects below. Which project is preferred if management makes its

Question:

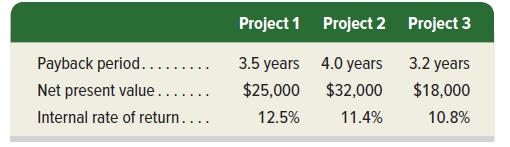

Lopez Co. is considering three alternative investment projects below. Which project is preferred if management makes its decision based on

(a) Payback period,

(b) Net present value, and

(c) Internal rate of return?

Project 1 Project 2 Project 3 Payback period........ Net present value .... Internal rate of return.... 3.5 years 4.0 years 3.2 years $25,000 $32,000 $18,000 12.5% 11.4% 10.8%

Step by Step Answer:

To determine the preferred investment project under each decision criterion we can analyze the infor...View the full answer

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Business questions

-

A manufacturer of cereal is considering three alternative box colors-red, yellow, and blue. To check whether such a consideration has any effect on sales, 16 stores of approximately equal size are...

-

Net Present Value Method, Internal Rate of Return Method, and Analysis.The management of Saturn Networks Inc. is considering two capital investment projects. The estimated net cash flows from each...

-

A company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. a. Compute the net...

-

An abc-sequence balanced three-phase wye-connected source supplies power to a balanced wye-connected load. The line impedance per phase is 1 + j10, and the load impedance per phase is 20 + j20. If...

-

Sixty kilograms per hour of water runs through a heat exchanger, entering as saturated liquid at 200 kPa and leaving as saturated vapor. The heat is supplied by a Carnot heat pump operating from a...

-

M. P. VanOyen Manufacturing has gone out on bid for a regulator component. Expected demand is 700 units per month. The item can be purchased from either Allen Manufacturing or Baker Manufacturing....

-

It is desired to relate E1y2 to a quantitative variable x1 and a qualitative variable at three levels. a. Write a first-order model. b. Write a model that will graph as three different second-order...

-

Bradbury Corporation turns its inventory five times each year, has an average payment period of 25 days, and has an average collection period of 32 days. The firms annual sales are $3.6 billion, its...

-

On November 7. Mura Company borrows $250,000 cash by signing a 90 day, 8%, $250,000 note payable 1. Compute the accrued interest payable on December 31 2. & 3. Prepare the joumal entries to record...

-

Use the Michaelis-Menten equation to calculate the missing values of [S] given below if Vmax = 5 mmol/min. Vims [S] K +[S] Plot [S] versus vo (not the reciprocals!). Draw a line parallel to the...

-

Pablo Company is considering buying a machine that will yield income of $1,950 and net cash flow of $14,950 per year for three years. The machine costs $45,000 and has an estimated $6,000 salvage...

-

Quail Co. is considering buying a food truck that will yield net cash inflows of $10,000 per year for seven years. The truck costs $50,000 and has an estimated $6,000 salvage value at the end of the...

-

Kiwifruit is subject to imperfect information because buyers cannot determine its sweetness its quality level by simple inspection. The sweetness level at the time of consumption is determined by the...

-

GATE 2024-EE Question

-

GATE 2024-EE Question

-

GATE 2024-EE Question

-

What is Netduino?

-

What is Appolonius theorem?

-

A summary of cash flows for Paradise Travel Service for the year ended May 31, 20Y6, follows: Cash receipts: Cash received from customers...................................$880,000 Cash received from...

-

Can partitioned join be used for r r.A s? Explain your answer

-

Assume Research In Motion will install and service a server to link all of a customers employees smartphones to a centralized company server, for an upfront flat price. How can RIM use a job order...

-

During the current month, a company that uses a job order cost accounting system purchases $70,000 in raw materials for cash. It then uses $22,000 of raw materials indirectly as factory supplies and...

-

During the current month, a company that uses a job order cost accounting system incurred a monthly factory payroll of $120,000, paid in cash. Of this amount, $30,000 is classified as indirect labor...

-

1. (A nice inharitage) Suppose $1 were invested in 1776 at 3.3% interest compounded yearly a) Approximatelly how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000?...

-

Why Should not the government subsidize home buyers who make less than $120K per year. please explain this statement

-

Entries for equity investments: 20%50% ownership On January 6, 20Y8, Bulldog Co. purchased 25% of the outstanding common stock of $159,000. Gator Co. paid total dividends of $20,700 to all...

Study smarter with the SolutionInn App