Rosetta Inc.s records contain the following information about the 2023 cash flows. Required Prepare a statement of

Question:

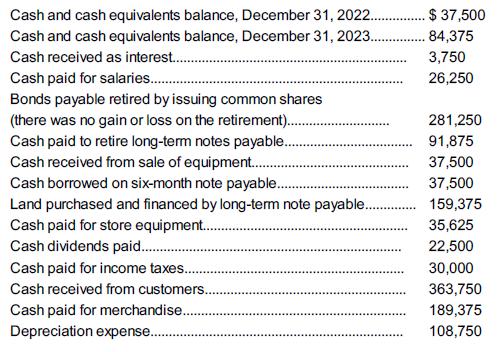

Rosetta Inc.’s records contain the following information about the 2023 cash flows.

RequiredPrepare a statement of cash flows using the direct method and a note describing non-cash investing and financing activities.

Transcribed Image Text:

Cash and cash equivalents balance, December 31, 2022........ Cash and cash equivalents balance, December 31, 2023.. Cash received as interest.... Cash paid for salaries........... Bonds payable retired by issuing common shares (there was no gain or loss on the retirement).. Cash paid to retire long-term notes payable... Cash received from sale of equipment........ Cash borrowed on six-month note payable.. Land purchased and financed by long-term note payable............ Cash paid for store equipment........... Cash dividends paid.... Cash paid for income taxes... Cash received from customers.. Cash paid for merchandise.. Depreciation expense.......... $ 37,500 84,375 3,750 26,250 281,250 91,875 37,500 37,500 159,375 35,625 22,500 30,000 363,750 189,375 108,750

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

Noncash investing and financing activitiesThe company issued common shares to retire 281250 of bonds ...View the full answer

Answered By

OTIENO OBADO

I have a vast experience in teaching, mentoring and tutoring. I handle student concerns diligently and my academic background is undeniably aesthetic

4.30+

3+ Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 2

ISBN: 9781260881332

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris

Question Posted:

Students also viewed these Business questions

-

Rosetta Inc.s records contain the following information about the 2014 cash flows. Cash and cash equivalents balance, December 31, 2013 ....................................... $ 37,500 Cash and cash...

-

Rosetta Inc.s records contain the following information about the 2020 cash flows. Cash and cash equivalents balance, December 31, 2019.......................... $ 37,500 Cash and cash equivalents...

-

Using the following information about McAuliff e Company, decide whether you would want to loan money to thecompany. 2010 2011 2012 $1,295 (2,023) (1,450) 5,300 Net income. Cash provided by lused in)...

-

VMP = MRP for a price taker but not for a price searcher. Do you agree or disagree with this statement? Explain your answer.

-

Write the business rules reflected in this ERD.

-

What should this committee recommend to the school board with respect to retaining Maria Sanchez? What other recommendations should they make to the board given what they have learned from their...

-

Executive workout dropouts. Refer to the Journal of Sport Behavior (2001) study of variety in exercise workouts, presented in Exercise 7.140 (p. 389). One group of 40 people varied their exercise...

-

Lamp Light Limited (LLL) in E9-11 calculates a fixed overhead rate based on budgeted fixed overhead of $32,400 and budgeted production of 24,000 units. Actual results were as follows: Number of units...

-

24 ABC Company, at the end of its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows: Pretax financial income $200,000 Depron tax in...

-

In each of the following cases, use the information provided about the 2023 operations of River Bungee Inc. to calculate the indicated cash flow: Case A: Calculate cash paid for rent:...

-

In each of the following cases, use the information provided about the 2023 operations of Prestige Water Corp. to calculate the indicated cash flow: Case A: Calculate cash received from customers:...

-

Find the domain of functions 1 1 f(x ) = ,, 7> 9(x ) y/l - x2 - 1 ' Vx2 + 1 - x

-

Idenfity whether the following book - tax adjustments are permanent or temporary differences. ( a ) Federal Income Tax Expense ( b ) Depreciation Expense ( c ) Accrued Compensation ( d ) Dividends...

-

2 . ) Pozycki, LLC has reported losses of $ 1 0 0 , 0 0 0 per year since its founding in 2 0 1 6 . For 2 0 2 3 , Pozycki anticipates a profit of about $ 1 0 0 , 0 0 0 . There are 3 equal members of...

-

Elena is a single taxpayer for tax year 2023. On April 1st, 2022, Elena's husband Nathan died. On July 13, 2023, Elena sold the residence that Elena and Nathan had each owed and used as their...

-

Rodriguez Corporation issues 12,000 shares of its common stock for $56,600 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The...

-

Problem 3: A large rectangular plate is loaded in such a way as to generate the unperturbed (i.e. far-field) stress field xx = Cy; yy = -C x; Oxy = 0 The plate contains a small traction-free circular...

-

Explain the utilitarian, individualism, moral rights, justice, virtue ethics, and practical approaches for evaluating ethical behavior.

-

Catalytic hydrogenation of naphthalene over PdC results in rapid addition of 2 moles of H 2 . Propose a structure for this product.

-

At the end of May, the job cost sheets at Cool Pool show the following costs accumulated on three jobs. Additional information a. Job 8 was started in April, and the following costs were assigned to...

-

Match each of the terms with the best definition a through d. 1. Cost accounting system 2. Target cost 3. Job 4. Process operation a. Production activities for a custom product. b. Mass production in...

-

At the end of June, the job cost sheets at Ace Roofers show the following costs accumulated on three jobs. Additional information a. Job 5 was started in May, and the following costs were assigned to...

-

Just work out the assignment on your own sheet, you dont need the excel worksheet. Classic Coffee Company Best friends, Nathan and Cody, decided to start their own business which would bring great...

-

Financial information related to the proprietorship of Ebony Interiors for February and March 2019 is as follows: February 29, 2019 March 31, 2019 Accounts payable $310,000 $400,000 Accounts...

-

(b) The directors of Maureen Company are considering two mutually exclusive investment projects. Both projects concern the purchase of a new plant. The following data are available for each project...

Study smarter with the SolutionInn App