Solar Energy Inc. issued a $900,000, 5%, five-year bond on October 1, 2017. Interest is paid annually

Question:

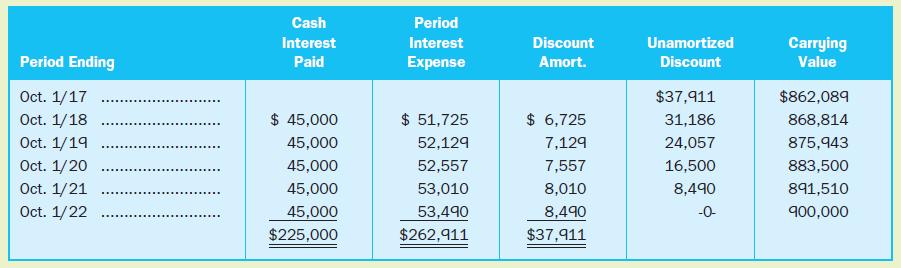

Solar Energy Inc. issued a $900,000, 5%, five-year bond on October 1, 2017. Interest is paid annually each October 1. Solar’s year-end is December 31.

Required

Using the amortization schedule provided below, record the entry to retire the bonds on October 1, 2020, for cash of:

a. $881,000

b. $883,500

c. $886,900

Transcribed Image Text:

Period Ending Oct. 1/17 Oct. 1/18 Oct. 1/19 Oct. 1/20 Oct. 1/21 Oct. 1/22 Cash Interest Paid $ 45,000 45,000 45,000 45,000 45,000 $225,000 Period Interest Expense $ 51,725 52,129 52,557 53,010 53,490 $262,911 Discount Amort. $ 6,725 7,129 7,557 8,010 8,490 $37,911 Unamortized Discount $37,911 31,186 24,057 16,500 8,490 -0- Carrying Value $862,089 868,814 875,943 883,500 891,510 900,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

a b c 2020 Oct 1 Bonds Paya...View the full answer

Answered By

Abhishek Kumar

I have done my bachelor of engineering in the stream of Electronics and Telecommunication from Pune University. I have done my schooling from Bihar Secondary Education board.

I have one year of experience in tutoring. In my college time(4th year), I started home tuition. I used to teach under 10th-grade subject like Mathematics, Physics, Chemistry, English, etc. I have learned so many things between this period about professionalism.

0.00

0 Reviews

10+ Question Solved

Related Book For

Fundamental Accounting Principles Volume 2

ISBN: 9781259087363

15th Canadian Edition

Authors: Kermit Larson, Heidi Dieckmann

Question Posted:

Students also viewed these Business questions

-

On January 1, 2016, the Sohape Corporation issued $ 100,000 par value, five- year bonds with a 3% stated interest rate. Interest is paid annually each December 31. The market rate of interest on the...

-

Annapolis Company purchased a $2,000, 7%, 9-year bond at 99 and held it to maturity. The straight line method of amortization is used for both premiums & discounts. What is the net cash received...

-

Zeus Energy Inc. issued a $900,000, 5%, five-year bond on October 1, 2014. Interest is paid annually each October 1. Zeuss year-end is December 31. Required Using the amortization schedule provided...

-

Discriminate the Enablers and the Inhibitors to IT strategy alignment from the below IT fails to meet commitments IT does not understand business IT involved in strategy development IT understands...

-

Describe the additional documentation requirements of Generally Accepted Government Auditing Standards.

-

The comparative balance sheets and an income statement for Raceway Corporation follow: Income Statement For the Year Ended December 31, 2014 Sales ........... $480,000 Cost of goods sold .........

-

Malicious attacks on a cryptocurrency network. Refer to the Computers & Security (January 2020) study of a software system developed for cryptocurrency, Exercise

-

The financial statements at the end of Miramar, Inc.'s first month of operation are shown below. By analyzing the interrelationships among the financial statements, fill in the proper amounts for (a)...

-

Urban Glam Cosmetics made purchases of lipstick in the current year as follows: Jan. 1 Beginning inventory Mar. 14 Purchased July 30 Purchased Units available for sale 77 units @ $13.00 260 units @...

-

The cost and fair value of non-strategic investments of International Journalist Corporation on December 31, 2017, and December 31, 2018, are as follows: Required 1. Prepare the fair value adjustment...

-

On October 1, 2017, Best Biopharma Inc. issued a $750,000, 7%, seven-year bond. Interest is to be paid annually each October 1. Required a. Calculate the issue price of the bond assuming a market...

-

Long-term obligations usually are reclassified and reported as current liabilities when they become payable within the upcoming year (or operating cycle, if longer than a year). So, a 25-year bond...

-

Year 5% 6% 4 3.546 3.465 5 7% 3.387 3.312 4.329 4.212 4.100 8% 3.993 5.076 4.917 4.767 4.623 Present Value of an Annuity of $1 at Compound Interest 9% 10% 11% 12% 13% 14% 15% 3.240 3.170 3.102 3.037...

-

2. Determine the overturning stability of the cantilever retaining wall shown. The equivalent fluid density is 5.5 kN/m, soil density is 18 kN/m, and the concrete weighs 23.5 kN/m. (5 pts) 2 m 2 m 2...

-

A. For a certain two-dimensional, incompressible flow field the velocity component in the y direction is given by v = 3xy + xy 1. (05 pts) Short answer, what is the condition for this flow field to...

-

Cho0se a hazardous material to cr3ate a pr3sentation on (i.e. sulfuric acid, explosives, used needles, there are many types of hazardous materials) Cr3ate a presentation (P0werPoint, Open0ffice...

-

If det [a b] = c d 2 -2 0 a. det c+1 -1 2a d-2 2 2b -2 calculate:

-

A recent college graduate begins a savings plan at age 27 by investing $400 at the end of each month in an account that earns 7.5%, compounded monthly. (a) If this plan is followed for 10 years, how...

-

A certain Christmas tree ornament is a silver sphere having a diameter of 8.50 cm. Determine an object location for which the size of the reflected image is three-fourths the size of the object. Use...

-

Stone Works is a paving stone installation business that operates from about April to October each year. The company has an outstanding reputation for the quality of its work and as a result...

-

On November 3, 2023, Gamez 2 Go Media exchanged an old computer for a new computer that had a list price of $190,000. The original cost of the old computer was $150,000 and related accumulated...

-

On January 2, 2023, Brook Company acquired machinery by issuing a 3%, $360,000 note due in five years on December 31, 2027. Annual payments are $78,608 each December 31. The payment schedule is: ...

-

Suppose the S&P 500 currently has a level of 960. One contract of S&P 500 index futures has a size of $250 S&P 500 index. You wish to hedge an $800,000-portfolio that has a beta of 1.2. (A)In order...

-

Exhibit 4.1 The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during...

-

Haley is 57 years of age. She is planning for future long-term care needs. She knows that yearly nursing home costs in her area are currently $69,000, with prices increased by 5 percent annually....

Study smarter with the SolutionInn App